BuySellBA

Administrator

With little credit participation, in the first half of the year some 20,000 properties were sold in CABA, the best figure since 2019 - Infobae

Source:

www.infobae.com

www.infobae.com

August 14, 2024

A report confirmed this figure up to June and confirmed that listing prices show an average year-on-year increase of up to 5% in dollars for used and brand new properties, while prices for new construction properties rose more sharply.

By Jose Luis Cieri

The number of purchase and sale operations in CABA has increased and the sector is moving towards a change of trend compared to the last 5 years (Illustrative Image Infobae)

According to the College of Notaries of the City of Buenos Aires, 19,952 sales transactions were completed in the city of Buenos Aires until June. A private report on the real estate market confirmed that this figure registered a 25.4% year-on-year increase, which marked the highest volume transacted since 2019.

Almost 97% of these transactions were carried out by individuals or families who have their own savings or because they sold a property and were able to expand or reduce its surface area. The impact of the reintroduction of UVA mortgage loans, which are only now beginning to have an effect , will be seen in the next measurements.

Fabián Achával , from Fabián Achával Propiedades, who analyzes the Buenos Aires real estate market through Radar Inmobiliario, attributes the year-on-year increase in the number of deeds executed in June in CABA to three main factors: “property prices, which are historically low (comparable to 2004 levels in real terms); the sharp increase in construction costs, which implies higher prices in the future; and a change in market expectations,” he told Infobae .

Although there was a 7.8% drop in deeds compared to May, Achával interprets that exchange rate volatility always impacts the number of transactions, although the trend of visits and enquiries to real estate agencies continues to rise .

Mortgage transactions reached 141 transactions (+5.5% year-on-year) and continue to have a low participation in the total number of transactions carried out in CABA, with only 2.7% of the total.

“At the end of April, UVA mortgage loans from different banks began to proliferate and therefore a short-term upturn is expected. The key variable to observe is the real salary in dollars, which today is 38% lower than it was in Mauricio Macri's first wave of UVA loans (second half of 2016). The performance compared to its launch is similar,” Achával said.

The sector reported that the demand for housing is so great that the news of UVA loans was well received, even in a challenging macroeconomic context. Mortgage loans will slowly increase as banks generate the necessary logistics, similar to what happened during the Macri administration.

Source: Real Estate Radar

The relaunch of mortgage loans caused a significant increase in enquiries, representing 30% of the calls received. “These enquiries often translate into concrete visits to the properties, indicating a real and active interest on the part of buyers,” said Jimena Maderna , from Maderna Relaciones Inmobiliarias.

Two-room apartments are the most sought after by those who use the new mortgage loans, especially for their own home. These buyers focus on properties with a value of up to USD 150,000, prioritizing well-connected locations with access to essential services.

Maderna added that, in terms of completed sales, two-room apartments, followed by three-room apartments, have dominated the market in recent months. “This trend is due to financial accessibility, high demand for owning a home and the preference for well-connected locations.”

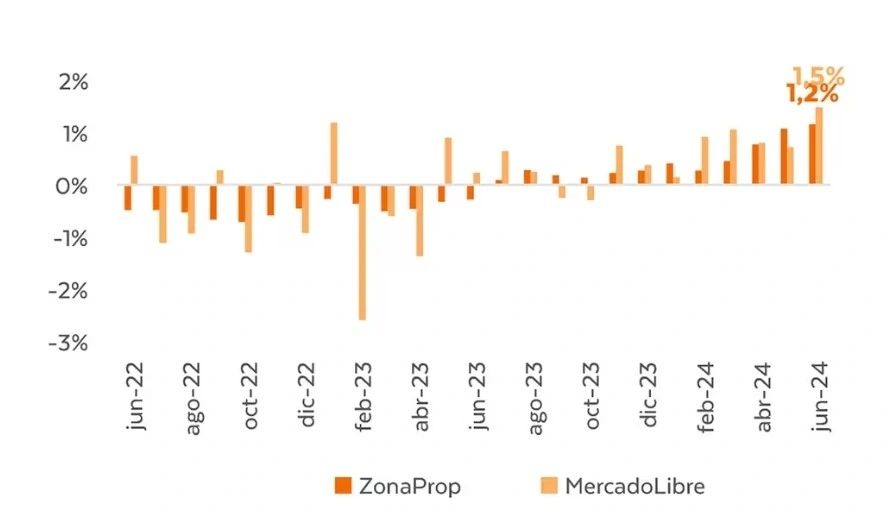

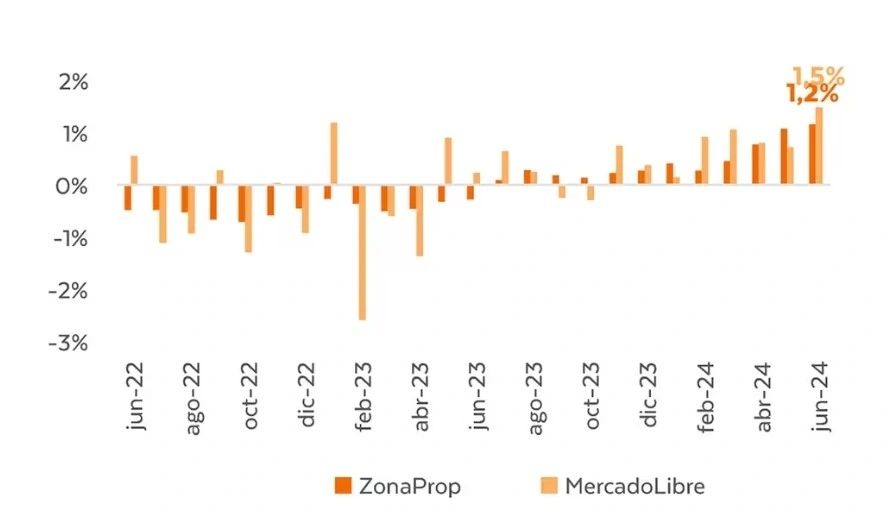

According to Zonaprop, in June, publication prices increased by 5.5% year-on-year and have accumulated five months of growth after 55 months of decline. Mercado Libre also reports five consecutive months of growth with a 4.6% year-on-year increase.

The dynamics of listing prices varies by segment. In June, properties in the pipeline led with a 12.8% year-on-year increase due to the increase in building costs measured in dollars that are beginning to be transferred to units under construction, followed by brand new properties with 8.2%, and used properties with 3.6%, below the average in CABA.

Source: Real Estate Radar

List prices for new listings according to Mercado Libre and the University of San Andrés increased by 11.2% year-on-year in July.

Achával added: “New listings are coming in at higher prices, which anticipates an upward cycle in closing prices, especially for properties up to $100,000. The segments from $100,000 to $200,000 show less impact and those over $200,000 remain stable.”

Source: Radar Inmobiliario, in monthly terms, Zonaprop showed an increase of 1.2%, while Mercado Libre reported a rise of 1.5%

As an example, based on Zonaprop values, used apartments appreciated year-on-year as follows: in Puerto Madero, values went from USD 5,395 to USD 5,683 per square meter, an increase of 5%; in Palermo, from USD 2,770 to USD 2,974, an increase of 7%; in Belgrano, from USD 2,527 to USD 2,676, growing by 6%; in Núñez, from USD 2,537 to USD 2,701, also with an increase of 6%; in Recoleta, from USD 2,435 to USD 2,507, which represents an increase of 3%; and in Caballito, from USD 1,969 to USD 2,071 per m2, an increase of 5% year-on-year.

“Despite the macroeconomic challenges, the real estate market remains in a microclimate of growth. Mortgage loans and money laundering are expected to start to pick up in the coming months,” Achával concluded.

www.buysellba.com

Source:

Con escasa participación del crédito, en el primer semestre se vendieron unas 20.000 propiedades en CABA, el mejor dato desde 2019

Un informe confirmó esta cifra hasta junio y ratificó que los valores de publicación muestran un aumento promedio interanual de hasta 5% en dólares en propiedades usadas y a estrenar, mientras que en pozo ascendieron con más fuerza

August 14, 2024

A report confirmed this figure up to June and confirmed that listing prices show an average year-on-year increase of up to 5% in dollars for used and brand new properties, while prices for new construction properties rose more sharply.

By Jose Luis Cieri

The number of purchase and sale operations in CABA has increased and the sector is moving towards a change of trend compared to the last 5 years (Illustrative Image Infobae)

According to the College of Notaries of the City of Buenos Aires, 19,952 sales transactions were completed in the city of Buenos Aires until June. A private report on the real estate market confirmed that this figure registered a 25.4% year-on-year increase, which marked the highest volume transacted since 2019.

Almost 97% of these transactions were carried out by individuals or families who have their own savings or because they sold a property and were able to expand or reduce its surface area. The impact of the reintroduction of UVA mortgage loans, which are only now beginning to have an effect , will be seen in the next measurements.

Fabián Achával , from Fabián Achával Propiedades, who analyzes the Buenos Aires real estate market through Radar Inmobiliario, attributes the year-on-year increase in the number of deeds executed in June in CABA to three main factors: “property prices, which are historically low (comparable to 2004 levels in real terms); the sharp increase in construction costs, which implies higher prices in the future; and a change in market expectations,” he told Infobae .

Although there was a 7.8% drop in deeds compared to May, Achával interprets that exchange rate volatility always impacts the number of transactions, although the trend of visits and enquiries to real estate agencies continues to rise .

Mortgage transactions reached 141 transactions (+5.5% year-on-year) and continue to have a low participation in the total number of transactions carried out in CABA, with only 2.7% of the total.

“At the end of April, UVA mortgage loans from different banks began to proliferate and therefore a short-term upturn is expected. The key variable to observe is the real salary in dollars, which today is 38% lower than it was in Mauricio Macri's first wave of UVA loans (second half of 2016). The performance compared to its launch is similar,” Achával said.

The sector reported that the demand for housing is so great that the news of UVA loans was well received, even in a challenging macroeconomic context. Mortgage loans will slowly increase as banks generate the necessary logistics, similar to what happened during the Macri administration.

Source: Real Estate Radar

The relaunch of mortgage loans caused a significant increase in enquiries, representing 30% of the calls received. “These enquiries often translate into concrete visits to the properties, indicating a real and active interest on the part of buyers,” said Jimena Maderna , from Maderna Relaciones Inmobiliarias.

Two-room apartments are the most sought after by those who use the new mortgage loans, especially for their own home. These buyers focus on properties with a value of up to USD 150,000, prioritizing well-connected locations with access to essential services.

Maderna added that, in terms of completed sales, two-room apartments, followed by three-room apartments, have dominated the market in recent months. “This trend is due to financial accessibility, high demand for owning a home and the preference for well-connected locations.”

On the rise

It is crucial to analyze the release values and closing prices separately, as their movements may not coincide.According to Zonaprop, in June, publication prices increased by 5.5% year-on-year and have accumulated five months of growth after 55 months of decline. Mercado Libre also reports five consecutive months of growth with a 4.6% year-on-year increase.

Listing prices have been sharply corrected after more than a year of transparency, resulting in a more refined offer. The increase in construction costs has a greater impact on low-income housing.

The dynamics of listing prices varies by segment. In June, properties in the pipeline led with a 12.8% year-on-year increase due to the increase in building costs measured in dollars that are beginning to be transferred to units under construction, followed by brand new properties with 8.2%, and used properties with 3.6%, below the average in CABA.

Source: Real Estate Radar

List prices for new listings according to Mercado Libre and the University of San Andrés increased by 11.2% year-on-year in July.

Achával added: “New listings are coming in at higher prices, which anticipates an upward cycle in closing prices, especially for properties up to $100,000. The segments from $100,000 to $200,000 show less impact and those over $200,000 remain stable.”

Source: Radar Inmobiliario, in monthly terms, Zonaprop showed an increase of 1.2%, while Mercado Libre reported a rise of 1.5%

As an example, based on Zonaprop values, used apartments appreciated year-on-year as follows: in Puerto Madero, values went from USD 5,395 to USD 5,683 per square meter, an increase of 5%; in Palermo, from USD 2,770 to USD 2,974, an increase of 7%; in Belgrano, from USD 2,527 to USD 2,676, growing by 6%; in Núñez, from USD 2,537 to USD 2,701, also with an increase of 6%; in Recoleta, from USD 2,435 to USD 2,507, which represents an increase of 3%; and in Caballito, from USD 1,969 to USD 2,071 per m2, an increase of 5% year-on-year.

“Despite the macroeconomic challenges, the real estate market remains in a microclimate of growth. Mortgage loans and money laundering are expected to start to pick up in the coming months,” Achával concluded.

www.buysellba.com