BuySellBA

Administrator

With the appearance of credit, deeds grew by almost 30% in August and it was the best record in the last 75 months - Infobae

Source:

www.infobae.com

www.infobae.com

September 24, 2024

For the first time since May 2018, almost 5,300 notarial acts were carried out involving an amount of $515,023 million. 416 deeds were executed through mortgage loans, which represents a 133% year-on-year growth.

By Jose Luis Cieri

After more than 5 years, almost 5,300 deeds were made in CABA. The real estate market maintains an upward trend at this point (Illustrative Image Infobae)

The recent report on deeds carried out by the College of Notaries of the city of Buenos Aires confirmed the change in trend in the real estate market. The scenario is now positive, with 5,297 notarial acts carried out in August, the best record in the last 75 months.

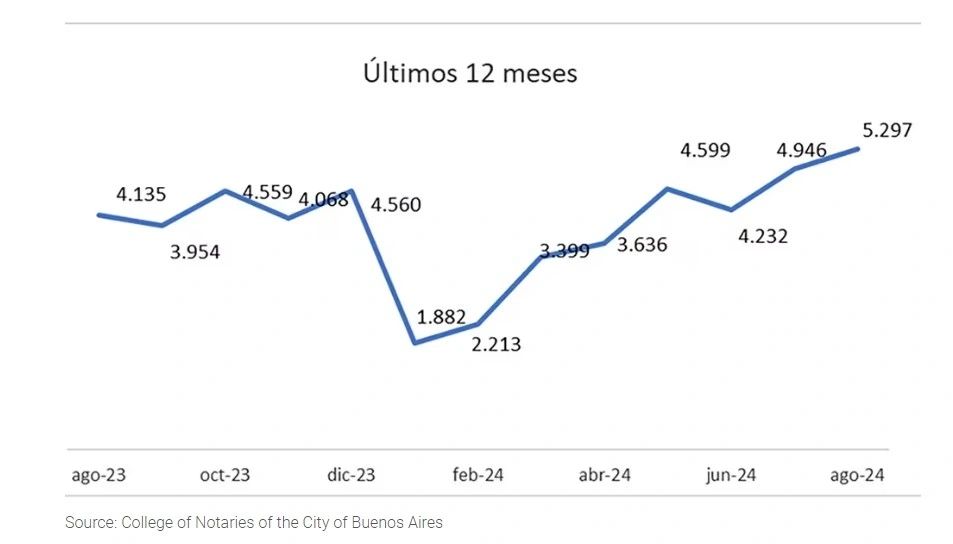

The total number of deeds of sale of real estate in the eighth month of 2024 registered an increase of 28.1% compared to the level of a year earlier, while the total amount of transactions carried out increased by 287.4%, with $515,023 million. Compared to July 2024, the acts increased by 7.1% (4,946 deeds had been made in that month).

Jorge De Bártolo , president of the College of Notaries of CABA, explained to Infobae that the recent increase in deeds is due to several factors. “First, greater confidence in closing deals since the last quarter of last year. Second, the impact of mortgage credit, which grew almost 300% in two months. Although there were few mortgages, August registered more than 400, marking the beginning of a growing trend.”

The average amount of the acts was $97,229,203 (USD 98,985, according to the average official exchange rate): it grew 202.4% in one year in pesos, and in US currency it rose 3.4 percent.

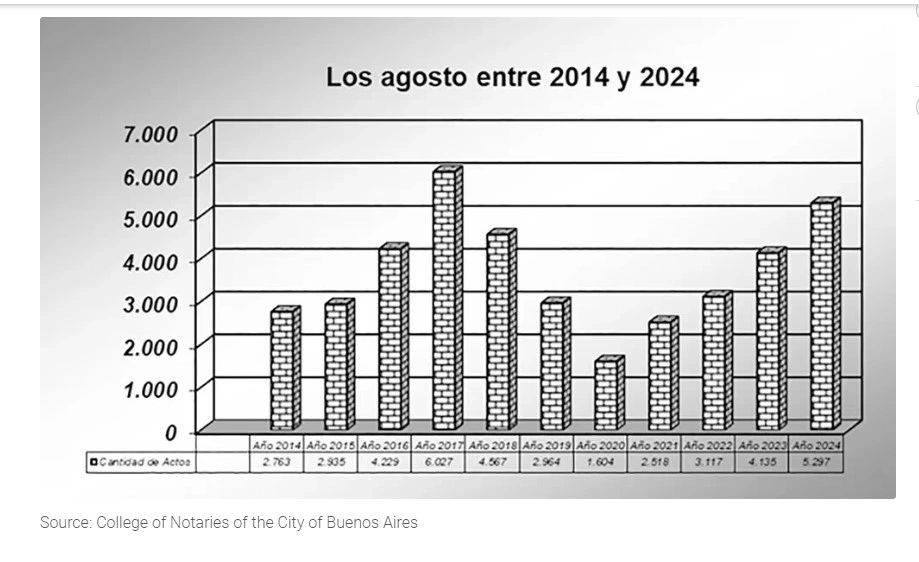

Alejandro Braña , a real estate expert and member of the Colegio Inmobiliario Buenos Aires, told Infobae that, “with 5,297 deeds, August 2024 becomes the second best August in the last 11 years, surpassed only by 2017 when 6,027 deeds were made. At that time, the UVA mortgage loans of the Mauricio Macri era had a strong impact.”

"Although the number is favorable for the first time this year, it is still low compared to 2017 levels, when more than 1,000 credit transactions were carried out per month in CABA," Braña added.

At this point, it was observed that new mortgage loans are influencing the growth of real estate purchases.

“In Argentina, housing is a legitimate aspiration for any family, and any incentive to buy is positive. Although the rental market has adjusted, buying will be preferred if inflation stabilizes. From the College we ask that the management of files be agile to avoid delays in the deeds,” added De Bártolo.

Regarding the profile of buyers who opt for mortgage loans, De Bártolo indicated that it is still incipient, but greater interest has begun to be observed among young couples with family help or families looking to expand their home.

Credit creates a market, as it introduces new actors who, without the credit incentive, would not be able to participate.

De Bártolo added: “When there is credit, chain operations begin. Whoever sells to a buyer with credit will probably buy another property, creating a virtuous circle. At the peak of UVA credits, they represented almost 40% of the total volume of a month. Without loans, it never exceeded 4%.”

Source: College of Notaries of the City of Buenos Aires

Fabián Achával , CEO of Fabián Achával Properties, who produces Radar Inmobiliario, said: “Behind this sharp increase in transactions we find, on the one hand, a significant change in expectations that began slowly towards the end of 2023 and, on the other, the low prices per square meter of properties. In this sense, the real estate market is currently experiencing a microclimate of growth.”

Regarding the role of new policies or incentives - such as money laundering or exchange rate stability - in the increase in real estate transactions, Achával commented that, although it is true that the new lines of mortgage credit and money laundering have not yet fully impacted the number of transactions, economic policies have contributed favorably to the change in expectations, which is a key element to explain the increase in demand.

Following the increase in transactions between July and August, the last quarter of the year is expected to continue this trend with great activity. De Bártolo stated: “It would not be strange to exceed 6,000 deeds, and with more credit, reach higher figures. This growth is expected to continue and the market to remain strong.”

Regarding the recent reactivation of mortgage lending, they explained that it is normal for banks to take time to adjust their structures to meet the increase in demand.

“In the coming months, we expect an increase in purchase and sale transactions. Seasonally, the last quarter of each year is the one with the highest volume of transactions, and the impact of money laundering and credits will also be added. We estimate that we will close a great year in all segments: used residential and developments,” Achával concluded.

www.buysellba.com

Source:

Con la aparición del crédito, crecieron casi 30% las escrituras en agosto y fue el mejor registro de los últimos 75 meses

Por primera vez desde mayo de 2018, se realizaron casi 5.300 actos notariales que involucraron un monto de $515.023 millones. Se efectuaron 416 escrituras a través de créditos hipotecarios, lo que representa un crecimiento del 133% interanual

September 24, 2024

For the first time since May 2018, almost 5,300 notarial acts were carried out involving an amount of $515,023 million. 416 deeds were executed through mortgage loans, which represents a 133% year-on-year growth.

By Jose Luis Cieri

After more than 5 years, almost 5,300 deeds were made in CABA. The real estate market maintains an upward trend at this point (Illustrative Image Infobae)

The recent report on deeds carried out by the College of Notaries of the city of Buenos Aires confirmed the change in trend in the real estate market. The scenario is now positive, with 5,297 notarial acts carried out in August, the best record in the last 75 months.

The total number of deeds of sale of real estate in the eighth month of 2024 registered an increase of 28.1% compared to the level of a year earlier, while the total amount of transactions carried out increased by 287.4%, with $515,023 million. Compared to July 2024, the acts increased by 7.1% (4,946 deeds had been made in that month).

Jorge De Bártolo , president of the College of Notaries of CABA, explained to Infobae that the recent increase in deeds is due to several factors. “First, greater confidence in closing deals since the last quarter of last year. Second, the impact of mortgage credit, which grew almost 300% in two months. Although there were few mortgages, August registered more than 400, marking the beginning of a growing trend.”

The average amount of the acts was $97,229,203 (USD 98,985, according to the average official exchange rate): it grew 202.4% in one year in pesos, and in US currency it rose 3.4 percent.

Alejandro Braña , a real estate expert and member of the Colegio Inmobiliario Buenos Aires, told Infobae that, “with 5,297 deeds, August 2024 becomes the second best August in the last 11 years, surpassed only by 2017 when 6,027 deeds were made. At that time, the UVA mortgage loans of the Mauricio Macri era had a strong impact.”

"Although the number is favorable for the first time this year, it is still low compared to 2017 levels, when more than 1,000 credit transactions were carried out per month in CABA," Braña added.

At this point, it was observed that new mortgage loans are influencing the growth of real estate purchases.

“In Argentina, housing is a legitimate aspiration for any family, and any incentive to buy is positive. Although the rental market has adjusted, buying will be preferred if inflation stabilizes. From the College we ask that the management of files be agile to avoid delays in the deeds,” added De Bártolo.

Exchange rate stability is helping to further unblock the real estate market, especially in a context of restrictions

Regarding the profile of buyers who opt for mortgage loans, De Bártolo indicated that it is still incipient, but greater interest has begun to be observed among young couples with family help or families looking to expand their home.

Credit creates a market, as it introduces new actors who, without the credit incentive, would not be able to participate.

De Bártolo added: “When there is credit, chain operations begin. Whoever sells to a buyer with credit will probably buy another property, creating a virtuous circle. At the peak of UVA credits, they represented almost 40% of the total volume of a month. Without loans, it never exceeded 4%.”

Factors that drove the market

This increase in real estate transactions signals a clear recovery in the sector, after more than 5 years of crisis and stagnation.

Source: College of Notaries of the City of Buenos Aires

Fabián Achával , CEO of Fabián Achával Properties, who produces Radar Inmobiliario, said: “Behind this sharp increase in transactions we find, on the one hand, a significant change in expectations that began slowly towards the end of 2023 and, on the other, the low prices per square meter of properties. In this sense, the real estate market is currently experiencing a microclimate of growth.”

Regarding the role of new policies or incentives - such as money laundering or exchange rate stability - in the increase in real estate transactions, Achával commented that, although it is true that the new lines of mortgage credit and money laundering have not yet fully impacted the number of transactions, economic policies have contributed favorably to the change in expectations, which is a key element to explain the increase in demand.

Following the increase in transactions between July and August, the last quarter of the year is expected to continue this trend with great activity. De Bártolo stated: “It would not be strange to exceed 6,000 deeds, and with more credit, reach higher figures. This growth is expected to continue and the market to remain strong.”

Regarding the recent reactivation of mortgage lending, they explained that it is normal for banks to take time to adjust their structures to meet the increase in demand.

“In the coming months, we expect an increase in purchase and sale transactions. Seasonally, the last quarter of each year is the one with the highest volume of transactions, and the impact of money laundering and credits will also be added. We estimate that we will close a great year in all segments: used residential and developments,” Achával concluded.

www.buysellba.com