BuySellBA

Administrator

With the money laundering, only houses in the pit can be bought - Infobae

Source:

Con el blanqueo solo podrán comprarse viviendas en pozo

Por ahora, el Ministerio de Economía confirmó que el sinceramiento abarca únicamente al sector de unidades en construcción. Inmobiliarios estiman que en unos días esta herramienta podría ampliarse para incluir inmuebles usados y a estrenar.

July 19, 2024

For now, the Ministry of Economy confirmed that the disclosure only covers the sector of units under construction. Real estate agents estimate that in a few days this tool could be extended to include used and brand new properties.

By Jose Luis Cieri

For now, money laundering is only authorized for investing in homes under construction.

The Government has disclosed the placements authorized by the Ministry of Economy for money laundering, offering new benefits to taxpayers who adhere to it. This measure has as its main objective to promote construction projects in the Argentine real estate market, allowing the laundered money to be invested in developments in the works.

The announcement follows the recent regulation of the Asset Regularization Regime by the AFIP, following the approval of the Ley Bases and the tax package, which allows the laundering of up to USD 100,000 without taxes.

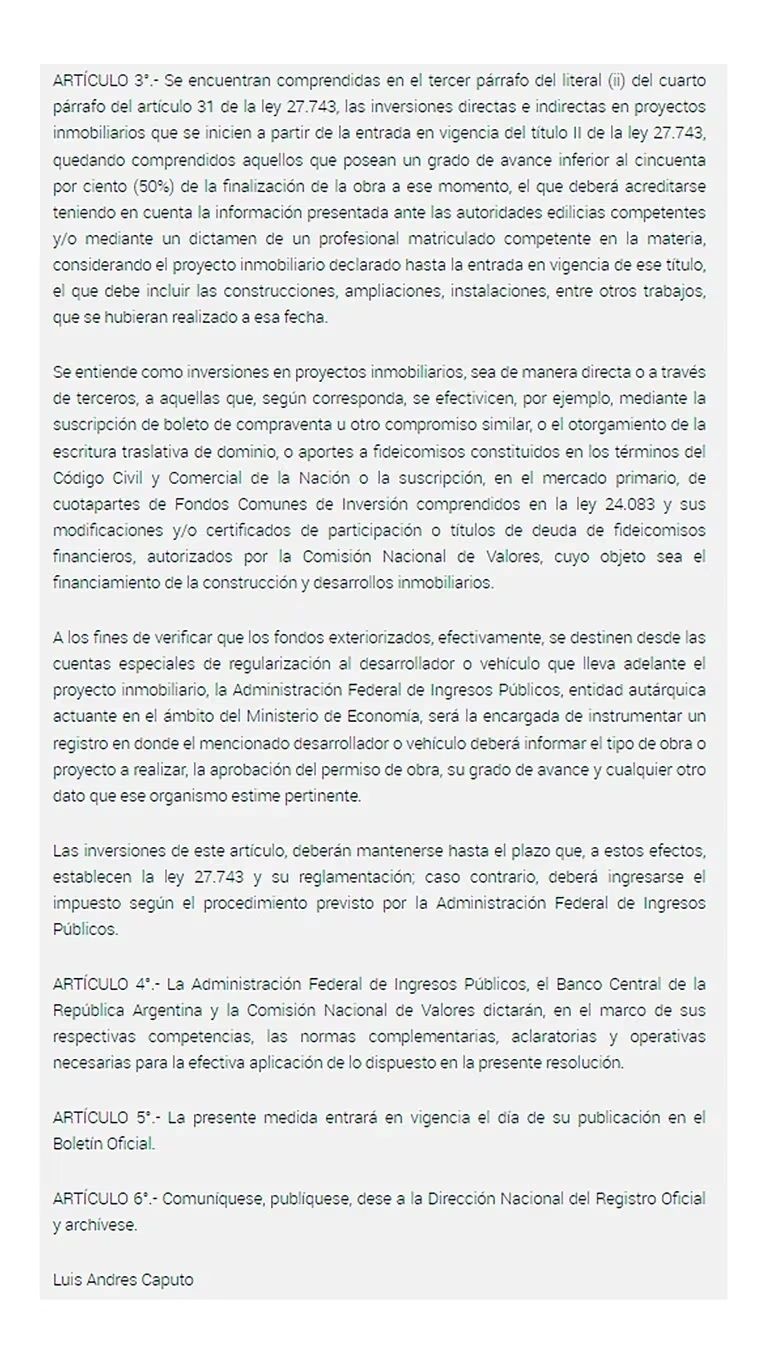

Direct and indirect investments in real estate projects may be made from the entry into force of Title II of Law 27,743, including those projects that have less than 50% progress towards completion of the work (see image from the Official Gazette below).

Although initially there was talk of allowing the purchase of properties in a well, new "brand new" and used, finally the regulation only allows it in the first (in a well) and under certain conditions ( it is estimated that in a few days the Money Laundering could be extended to the purchase of used and brand new properties , something that the chambers of the sector had already requested).

Sebastián Domínguez , CEO of SDC Asesores Tributarios, explained to Infobae that, according to Resolution 590/2024 of the Ministry of Economy, those who must pay the money laundering tax can avoid this payment if they allocate the laundered cash to direct and indirect investments in real estate projects started after July 8, 2024. “This includes those with a degree of progress of less than 50% of the completion of the work on that date. In addition, these investments can be made directly or through third parties, by signing purchase and sale agreements, granting deeds of transfer of ownership, contributions to trusts, among other forms.”

Currently, in CABA it is estimated that there are more than 50,000 homes under construction, of which approximately 60% apply according to the money laundering regulations.

As for the duration of the investment, those who launder the cash must maintain the investments in real estate projects until December 31, 2025; otherwise, they will have to pay the corresponding tax. “The possibility of buying brand new and used properties should have been considered to promote the development of the construction industry and the recovery of the real estate market. Limiting investments only to real estate projects in the pipeline is very restrictive,” Domínguez added.

Article 3 of the Official Gazette explains how to raise funds in real estate projects

The segment offers opportunities in two areas: the purchase of used properties, benefiting from mortgage loans, and the financing of new construction (or construction in progress) through funds and participations in real estate companies or trusts.

Mariela Schenone , CEO of Metro Futuro Real Estate, stressed that these types of investments are safe to the extent that they are backed by the developer and/or builder, include the land in their assets, and have an economic, financial, and legal plan that protects the investor. “This turns the investment into an opportunity to allocate the regularized money to a productive activity that boosts the economy and generates significant returns.”

This measure is expected to boost ongoing housing projects. Damián Tabakman , from the Chamber of Urban Developers (CEDU), commented that “the recent tax on property is great news, very much welcomed by us and fulfilled by the Minister of Economy, Luis Caputo , as he had promised. We believe that it will be well received and have a positive impact, since our activity generates investment and employment. Collecting the tax on property tax to promote greater activity and work is highly favorable for the State.”

This new tax is expected to boost the construction of buildings throughout the country.

Advantages and disadvantages

The main advantage for the taxpayer who regularizes his money is the possibility of moving it to acquire a safe real estate asset at low prices, taking advantage of the availability of cash. This prevents the money from being immobilized and losing value until December 31, 2025, in addition to saving the cost of laundering for those amounts, which is 5%; “by allocating the regularized money to investments in real estate projects in progress, not only does the individual investor benefit but also the growth of the construction industry is encouraged, generating employment and boosting the economy,” added Schenone.Bleaching has several significant advantages, such as:

- Zero cost: Regularizing assets up to USD 100,000 is free of charge.

- Lower rates: On the surplus, the rates are reduced, starting with 5% in the first stage.

- Releases: Exemption from taxes, interest, penalties and criminal prosecutions.

- Tax cap: Exempts from taxes on past assets and amounts consumed.

This benefit also applies to taxpayers who do not enter into the money laundering process, with a rate of 0.45 percent. Taxpayers classified as “compliant” will have a rate of 0.375% for their assets valued as of 12/31/2023, valid until 2027.

Domínguez said that “a possible disadvantage is the risk of increased tax pressure after the money laundering, similar to the tax on personal assets after the Fiscal Amnesty of the Macri Government. To mitigate this, the law allows to join the Special Income Regime of the Tax on Personal Assets (REIBP), offering long-term fiscal stability and limiting the future tax burden.”

In a real estate market like Argentina's, hungry for resources and without broad bank financing schemes ( Banco Nación recently launched loans to developers ), pit works will be a great channel to offer opportunities.

Private investors are driving the sector, and money laundering will allow regularised money to be directed to these developments. The high financial cost of the Argentine developer lowers prices for well-invested projects, generating opportunities with lower initial prices.

Schenone explained: “The money laundering and the possibility of allocating the regularized money to the real estate market will benefit buyers and will boost activity, generating jobs and stability for a sector that has been punished and with an increase in costs in dollars. The measure is urgent and necessary in order not to stop the market.”

Types of properties and how it will work

Initially, there was talk of allowing the purchase of properties in the form of a well, new “brand new” and used. However, the regulations will allow this only in the former (in the form of a well) and under certain conditions.Those who do not have their assets declared in the country will be able to launder up to USD 100,000 without paying any tax or penalty for undeclared assets.

For amounts exceeding USD 100,000, progressive rates are proposed: the earlier you enter the regime, the lower the rate to be paid:

- Until September 30, 2024: a 5% rate is paid on the excess of USD 100,000.

- Until December 31, 2024: the rate is 10%.

- Until March 31, 2025: the rate rises to 15%.

For those who must pay the money laundering tax, the Ministry of Economy, through Resolution 590/2024, regulated that payment of the tax can be avoided if the laundered cash is used for direct and indirect investments in real estate projects started after July 8, 2024. This includes those projects that are less than 50% complete by that date.

The real estate sector expects that new regulations will be released through the Whitewashing that will include the purchase of used and brand new properties shortly

Domínguez explained that these investments can be made directly or through third parties, through sales contracts, deeds of transfer of ownership and contributions to trusts. The money laundering process requires maintaining the investment in real estate projects until December 31, 2025 to avoid paying the tax.

To avoid this tax, the cash to be laundered must be deposited in a special account in an Argentine bank before September 30, 2024, and then transferred to a construction company for a real estate project with less than 50% progress. The investment must be maintained until December 2025.

Schenone concluded that the next step is to open a special account in a bank or a brokerage account in an ALyC to make the deposit. “The money must be immobilized until at least September 30. If the regularized money holding is less than USD 100,000 (or its equivalent in pesos), the laundering is free of charge and the money can be moved without problems after that period. If it is greater than USD 100,000, there will also be no cost as long as it remains immobilized until December 31, 2025 or it is decided to allocate it to the investments detailed in the regulations.”

www.buysellba.com