James Bond

Well-known member

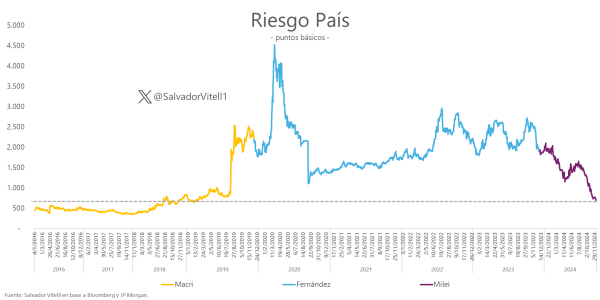

Agreed Craig. They have already announced that they can't pay some of it back now. It does look like Milei wants to honor all of the debt but I just wonder how they can pay all of the liabilities. It will take many, many years. But probably no different than many consumers. I have American friends and I am always amazed how much debt Americans have! 30 years debt on houses, 6 year car loans, student loan debt for decades, credit card bills. Then even when people get equity in their homes they take out more debt against their properties.Argentina has a lot of liabilities coming due, but they also have some great assets. I suspect the bigger battle ahead is whether citizens continue to vote for reform and sacrifice long enough to experience the benefits, and become a functioning economy once again. The history of socialist countries is not good in that regard.

I guess as long as the consumer keeps paying the banks then they will keep extending more debt! We aren't used to all of the debt that you Americans take on.