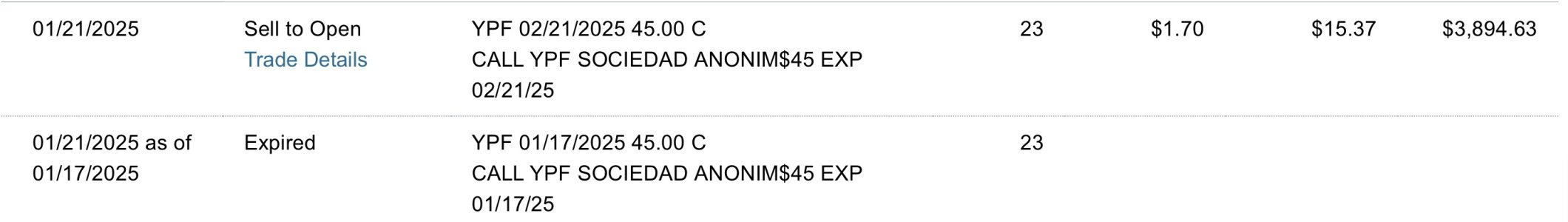

Well I don't look at it as smart or not. I hold a lot of YPF shares that I am holding for the long term anyway. I'm just taking a portion of it and being conservative. So you can see the example of my January 17 $45 call options expiring worthless because the stock was under $45. So I get to keep the money I made selling those options.

Now today I turned around and sold the next month's options. So February 21 $45 options. I sold them for $1.70 and after commissions got $3,894.63 US dollars for selling the right for someone to buy my YPF stock at $45 on or before February 21. The money is mine no matter what. If YPF stock goes above $45 all I will get is $45 per share.

Selling covered call options is a conservative approach but the yields can be extremely high. This is not investment advice.

View attachment 8485