All the Answers

Well-known member

The 3 reasons that pushed the MEP dollar below $1,200 for the first time in four months - Infobae

Source:

Los 3 motivos que empujaron a al dólar MEP debajo de los $1.200 por primera vez en cuatro meses

La cotización financiera se negocia este jueves a $1.198, un piso nominal desde el 30 de mayo, mientras que el “contado con liqui” opera a 1.223 pesps. La baja también es palpable para el libre, que recorta 20 pesos o 1,6%, a 1.240 pesos

September 19, 2024

The financial exchange rate is trading this Thursday at $1,198, a nominal floor since May 30, while the “contado con liqui” is trading at 1,223 pesps. The drop is also noticeable for the free exchange rate, which is down 20 pesos or 1.6%, to 1,240 pesos.

With greater supply, alternative dollar quotes are deepening their declines.

The dollar's exchange rate fell again this Thursday, due to three factors that converge in this trend.

These are:

- Entry of foreign currency into the system through money laundering .

- Official intervention with sale of dollars in the stock market.

- Greater supply of foreign currency to obtain pesos for the advance payment of Personal Property .

Thus, the MEP dollar is traded this Thursday at 1,198 pesos (-0.9%), a nominal floor since May 30, while the "cash with liquidity" dollar is traded at $1,223 through shares.

The decline is also palpable in the informal market, where the free-trade dollar dropped 20 pesos or 1.6% on the day, to $1,240 for sale, in the third consecutive round of decline. In September it fell 65 pesos or 5%. The exchange gap with the official exchange rate, at $964.50, is 28.6 percent.

In this way, the "blue" dollar has been falling for the third consecutive day, while financial parities have been falling for six consecutive days.

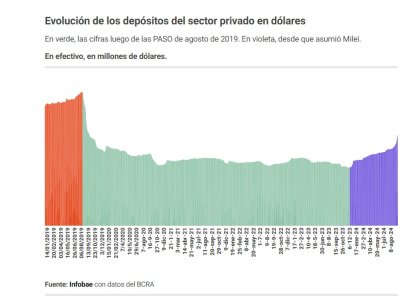

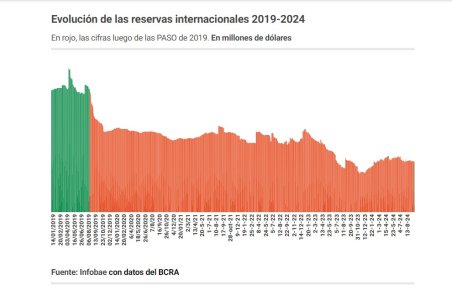

The money laundering factor is key in this framework to guarantee a significant volume of foreign currency in banks. Private deposits in foreign currency accounted for USD 21,946 million in cash on Monday, September 16 (+381 million or 1.8% compared to Friday, September 13), a maximum stock since September 18, 2019 (USD 22,207 million), according to data from the BCRA. Since Javier Milei took office, these placements have increased by USD 7,820 million or 55.4% from USD 14,126 million on Thursday, December 7, 2023.

“Regarding the impact that this could have on the price of financial dollars, we believe that the $1,200 level represents a solid floor. However, this could be surpassed if many people join the special regime of the Personal Property Tax, dollar deposits continue to increase and the Central Bank continues to sterilize the pesos generated by the purchase of reserves. However, as these factors lose strength, dollars could return to values between $1,250 and $1,300, aligning more with the dollar of monetary liabilities,” said Ignacio Morales , CIO ( Chief Investment Officer ) of Wise Capital.

"Although the daily balance and the reserves of the BCRA continue to be closely monitored, the flows mainly from money laundering -with dollar deposits growing very steadily- and from tax payments continue to lead, and so financial dollars are on their way to breaking through the 1,200 pesos mark, with chances of testing a 'gap' of close to 20%," said Gustavo Ber , an economist at Estudio Ber.

Amílcar Collante , an economist at Cesur (Center for Economic Studies of the South), stressed the impact of the “gradual lifting of the restrictions” after a relaxation of foreign trade restrictions by reducing “import quotas from four to two,” while “in September the PAIS Tax was lowered from 17.5% to 7.5%” and the total elimination of the PAIS Tax is planned for December.

“As for the contribution of foreign currency that the agro-export sector can generate in 2025, although there is still a long way to go and it will depend not only on prices but also on harvests - it will be very important that the weather is favorable - a first working scenario estimates exports for USD 31.6 billion, almost USD 500 million below the exports that would be achieved this year (-1.5%). If the previous number is adjusted for the lower spending on soybean purchases from neighboring countries, a common practice of the Argentine oil industry in recent years, the fall in foreign currency is reversed, leaving the net flow practically neutral, at the same level as that estimated for this year (around USD 29.4 billion)”, specified a report from the Ieral of the Fundación Mediterránea.