BuySellBA

Administrator

The real estate trend in the AMBA is reversed: which areas recover purchase and sale prices and why - Infobae

Source:

www.infobae.com

www.infobae.com

June 06, 2024

Since the beginning of 2024, some areas have recorded a 5.4% appreciation in prices after five years of consecutive falls. How supply and demand for rentals behave

By Jose Luis Cieri

Avenida del Libertador at 1700 in Vicente López, the top area for buying, selling and renting in pesos in Greater Buenos Aires

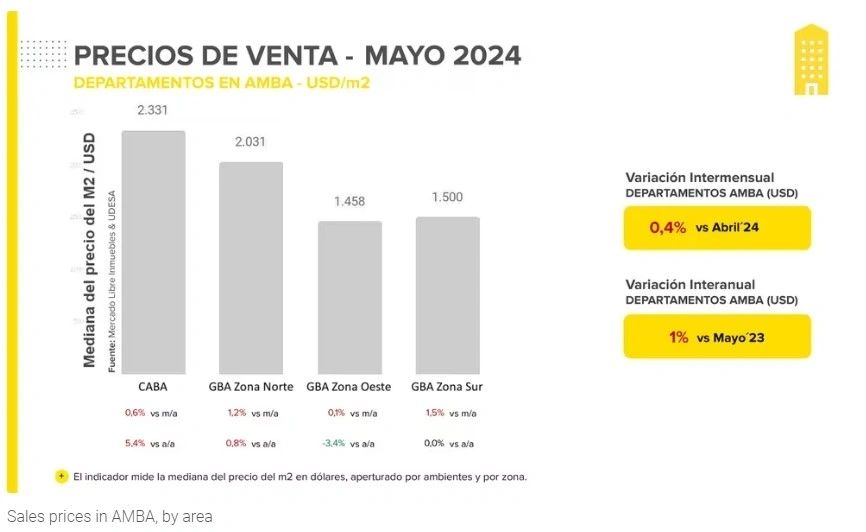

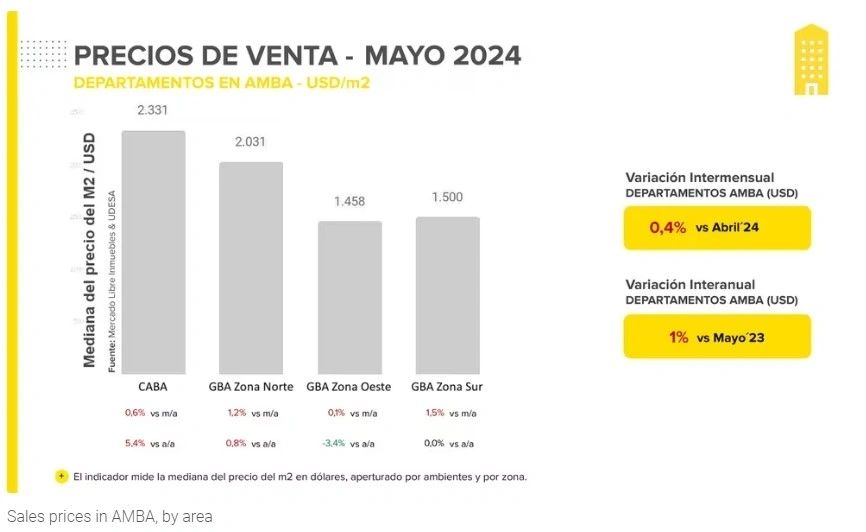

The Buenos Aires Metropolitan Area (AMBA), which includes the city of Buenos Aires and Greater Buenos Aires (GBA), shows signs of recovery in the real estate market. According to a private report, apartment prices stopped falling and in some areas registered an appreciation of 5.4% year-on-year.

However, house values (they only rose 2% in some GBA parties such as Ituzaingó and Tigre, among others) have not yet fully recovered, maintaining a more moderate trend compared to apartments.

In the departments, price variations were 5.4% in CABA, 0.8% in GBA North, and there were decreases on average of 3.4% in GBA West and no variations in GBA South.

This trend is driven by the reintroduction of mortgage loans , designed for the purchase, renovation or expansion of homes.

“Buyers are mainly end users, people who had savings in dollars and had postponed their purchase decision. Currently, they prefer to invest those funds in an asset. In 2023, the buyers were those with a surplus in pesos. Currently, we have positive developments for the sector, such as the decrease in the inflation rate and the supply of new credits, although it is premature to measure their impact, they are signs of a positive trend," Hugo Koifman , from Branson Real Estate.

According to the report – carried out by the University of San Andrés or Mercado Libre –, Puerto Madero at a value of USD 5,400 per square meter is at the forefront of apartment purchase and sale prices in CABA, followed by Palermo where they average USD 3,125 per m2.

Javier Igarzábal , from DIC Propiedades, highlighted that Vicente López was positioned as the neighborhood with the most expensive offer on the market, both for purchase and rental.

“Its strategic location between Avenida Maipú, the La Plata River, General Paz Avenue and Malaver Street, together with its proximity to CABA, guarantees very good connectivity and access to public transportation such as the train and Metrobús. In addition, it has health centers, prestigious schools, supermarkets, a varied gastronomic offer and shops of all kinds. This combination of services and the quality of life it offers, with important residences, leafy groves, security and tranquility, increases its attractiveness and price in the market,” he explained.

From the sector they confirmed that although prices are beginning to be published at higher values, opportunities still exist and closing prices are historically low.

For example, used two-room apartments of 45 m2 in Vicente López are around USD 110,000 and three-room apartments are worth USD 155,000, while new two-room units of 48 m2 are worth USD 150,000 and three-room apartments with 75 m2 are worth USD 200,000.

Corner of General Félix Olazábal and Camacuá in Ituzaingó, one of the most prosperous real estate areas in the west of the GBA

Agustín Vaccaro , from the Vaccaro Group, explained: “The strong inflation within the framework of a dollar that is maintained generates pressure on dollar prices, beginning to gradually reverse the behavior of dollar holders in negotiations. Before, they adopted a very aggressive attitude, but now, perceiving a loss in the value of the dollar over time, they seem to be more willing to close transactions in values closer to those published. This situation, added to the recent launch of UVA credit lines, is beginning to put pressure on property values.”

In the western area, such as Ituzaingó, Moreno and General Rodríguez, the price ranges vary, but are generally between USD 60,000 and USD 150,000 for apartments, and between USD 150,000 and USD 250,000 for houses.

“The apartment market is being reactivated, the type of housing hardest hit in recent years. Properties in private neighborhoods continue to be the most sought after, especially in the areas surrounding the Western Access between Ituzaingó and Moreno, and also in more remote areas such as General Rodríguez and Luján. Security, the natural environment with amenities and services, and the hybrid or home office work modality drove this trend, allowing buyers or tenants to consider more peripheral areas.”

In the case of houses, prices on average rose 10.6% in May. The increases were 0.8% in CABA, 12.4% in GBA North, 9.4% in GBA West and 8.6% in GBA South.

In rental values, the work confirmed that Vicente López is presented as the location with the most expensive offer in the GBA market, with an average value of $508,518 per month for two-room apartments.

“Before the DNU, we only had 12 rental properties for housing in the northern area and CABA, with client waiting lists. Now, without the Rental Law, the offer increased to more than 60 properties, giving tenants more options and the possibility of negotiating good prices, with contracts updateable quarterly in national currency. The option of accessing mortgage loans could also reduce the demand for rentals and slow down prices,” said Igarzábal.

The supply in the western zone of the GBA increased post-DNU, but it fails to compensate for the high level of demand, resulting from the loss of purchasing power of salaries, the consequent loss of savings capacity and the inability to access purchases.

In Ituzaingó, rents for three-room apartments with garage in residential areas range between $350,000 and $500,000 per month, depending on location, age and specific characteristics of the property. In Moreno, rental prices are approximately 20% lower.

“In the short term, if mortgage loans are successful and manage to be maintained over time, this situation could be reversed, generating a drop in rental demand that may contribute to the fact that their value does not continue to increase,” Vaccaro concluded.

www.buysellba.com

Source:

Se revierte la tendencia inmobiliaria en el AMBA: qué zonas recuperan los precios de compra venta y por qué

Desde el inicio de 2024, algunas zonas registran una apreciación del 5,4% en los precios tras cinco años de caídas consecutivas. Cómo se comportan la oferta y la demanda para alquileres

June 06, 2024

Since the beginning of 2024, some areas have recorded a 5.4% appreciation in prices after five years of consecutive falls. How supply and demand for rentals behave

By Jose Luis Cieri

Avenida del Libertador at 1700 in Vicente López, the top area for buying, selling and renting in pesos in Greater Buenos Aires

The Buenos Aires Metropolitan Area (AMBA), which includes the city of Buenos Aires and Greater Buenos Aires (GBA), shows signs of recovery in the real estate market. According to a private report, apartment prices stopped falling and in some areas registered an appreciation of 5.4% year-on-year.

However, house values (they only rose 2% in some GBA parties such as Ituzaingó and Tigre, among others) have not yet fully recovered, maintaining a more moderate trend compared to apartments.

In the departments, price variations were 5.4% in CABA, 0.8% in GBA North, and there were decreases on average of 3.4% in GBA West and no variations in GBA South.

This trend is driven by the reintroduction of mortgage loans , designed for the purchase, renovation or expansion of homes.

“Buyers are mainly end users, people who had savings in dollars and had postponed their purchase decision. Currently, they prefer to invest those funds in an asset. In 2023, the buyers were those with a surplus in pesos. Currently, we have positive developments for the sector, such as the decrease in the inflation rate and the supply of new credits, although it is premature to measure their impact, they are signs of a positive trend," Hugo Koifman , from Branson Real Estate.

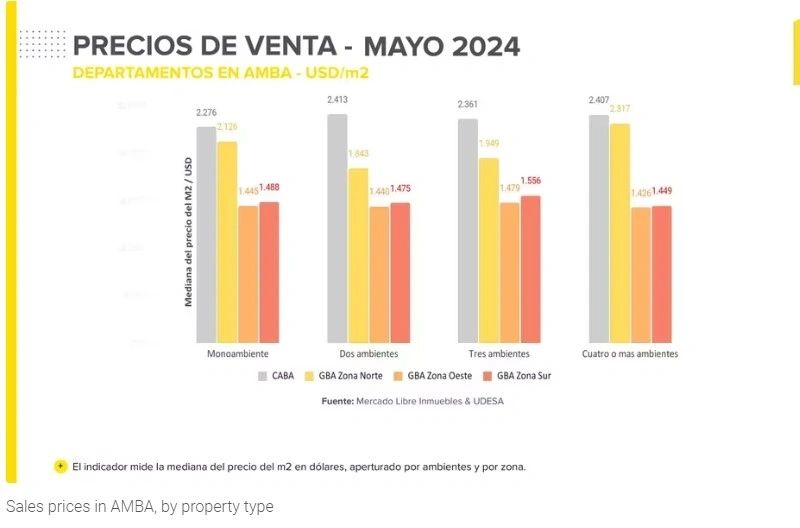

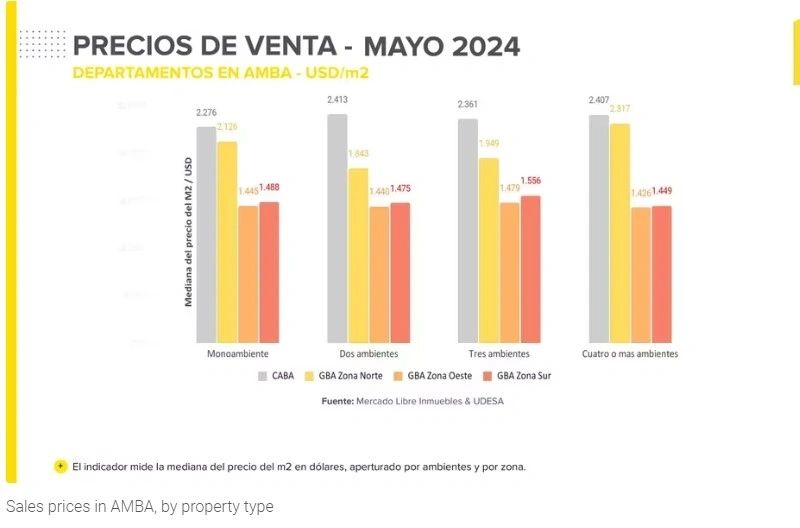

According to the report – carried out by the University of San Andrés or Mercado Libre –, Puerto Madero at a value of USD 5,400 per square meter is at the forefront of apartment purchase and sale prices in CABA, followed by Palermo where they average USD 3,125 per m2.

Who leads in the north

In GBA North, the average price per square meter for apartments for sale is $2,184. This value remains unchanged in April and continues to be 31.35% higher than the GBA West-South price, which is USD 1,592 per m2.Javier Igarzábal , from DIC Propiedades, highlighted that Vicente López was positioned as the neighborhood with the most expensive offer on the market, both for purchase and rental.

“Its strategic location between Avenida Maipú, the La Plata River, General Paz Avenue and Malaver Street, together with its proximity to CABA, guarantees very good connectivity and access to public transportation such as the train and Metrobús. In addition, it has health centers, prestigious schools, supermarkets, a varied gastronomic offer and shops of all kinds. This combination of services and the quality of life it offers, with important residences, leafy groves, security and tranquility, increases its attractiveness and price in the market,” he explained.

From the sector they confirmed that although prices are beginning to be published at higher values, opportunities still exist and closing prices are historically low.

For example, used two-room apartments of 45 m2 in Vicente López are around USD 110,000 and three-room apartments are worth USD 155,000, while new two-room units of 48 m2 are worth USD 150,000 and three-room apartments with 75 m2 are worth USD 200,000.

In the west zone

Recently, a trend of increasing prices for both purchase and rental prices was observed in the western part of the GBA, especially in apartments and properties in private neighborhoods. This increase is due to factors such as the sharp decline in sales values in recent years, with a drop of between 25% and 35%, reaching historical minimum levels.

Corner of General Félix Olazábal and Camacuá in Ituzaingó, one of the most prosperous real estate areas in the west of the GBA

Agustín Vaccaro , from the Vaccaro Group, explained: “The strong inflation within the framework of a dollar that is maintained generates pressure on dollar prices, beginning to gradually reverse the behavior of dollar holders in negotiations. Before, they adopted a very aggressive attitude, but now, perceiving a loss in the value of the dollar over time, they seem to be more willing to close transactions in values closer to those published. This situation, added to the recent launch of UVA credit lines, is beginning to put pressure on property values.”

In the western area, such as Ituzaingó, Moreno and General Rodríguez, the price ranges vary, but are generally between USD 60,000 and USD 150,000 for apartments, and between USD 150,000 and USD 250,000 for houses.

“The apartment market is being reactivated, the type of housing hardest hit in recent years. Properties in private neighborhoods continue to be the most sought after, especially in the areas surrounding the Western Access between Ituzaingó and Moreno, and also in more remote areas such as General Rodríguez and Luján. Security, the natural environment with amenities and services, and the hybrid or home office work modality drove this trend, allowing buyers or tenants to consider more peripheral areas.”

Rents slow down

Rents in AMBA slow down. According to the report, apartment prices increased 3.9% when comparing May with last April. The increases were 3.1% in CABA, 8.2% in GBA North, 4.6% in GBA West and 3.7% in GBA South.In the case of houses, prices on average rose 10.6% in May. The increases were 0.8% in CABA, 12.4% in GBA North, 9.4% in GBA West and 8.6% in GBA South.

In rental values, the work confirmed that Vicente López is presented as the location with the most expensive offer in the GBA market, with an average value of $508,518 per month for two-room apartments.

“Before the DNU, we only had 12 rental properties for housing in the northern area and CABA, with client waiting lists. Now, without the Rental Law, the offer increased to more than 60 properties, giving tenants more options and the possibility of negotiating good prices, with contracts updateable quarterly in national currency. The option of accessing mortgage loans could also reduce the demand for rentals and slow down prices,” said Igarzábal.

The supply in the western zone of the GBA increased post-DNU, but it fails to compensate for the high level of demand, resulting from the loss of purchasing power of salaries, the consequent loss of savings capacity and the inability to access purchases.

In Ituzaingó, rents for three-room apartments with garage in residential areas range between $350,000 and $500,000 per month, depending on location, age and specific characteristics of the property. In Moreno, rental prices are approximately 20% lower.

“In the short term, if mortgage loans are successful and manage to be maintained over time, this situation could be reversed, generating a drop in rental demand that may contribute to the fact that their value does not continue to increase,” Vaccaro concluded.

www.buysellba.com