BuySellBA

Administrator

The surprising fact confirms that it is the best time to buy a property - Infobae

Source:

www.lanacion.com.ar

www.lanacion.com.ar

September 25, 2024

The number is encouraging for the real estate market; in August, mortgage loans had a direct impact and the big question is: will this increase in property purchases affect the value of the properties?

By Candle Contreras

August deed data encourages the real estate market Shutterstock

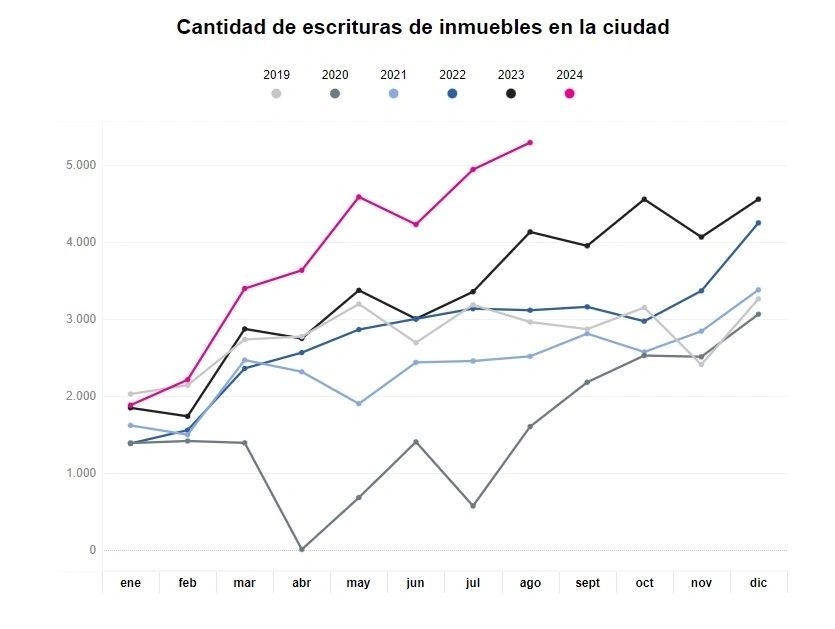

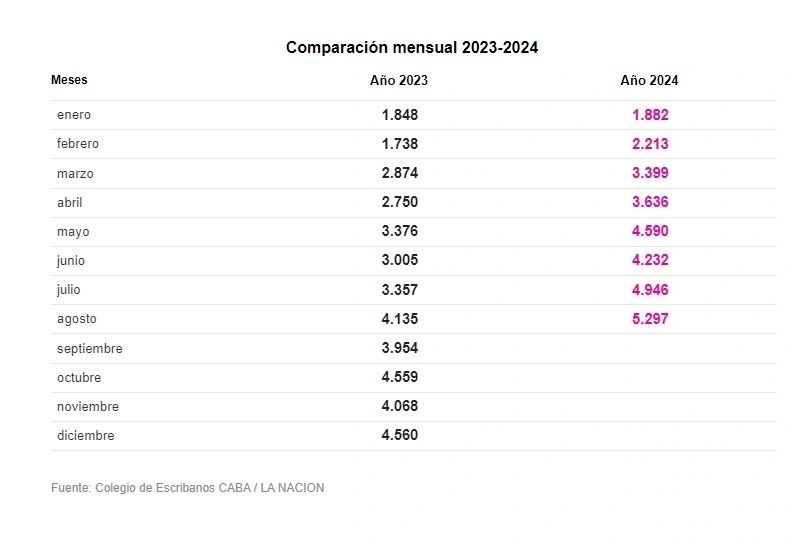

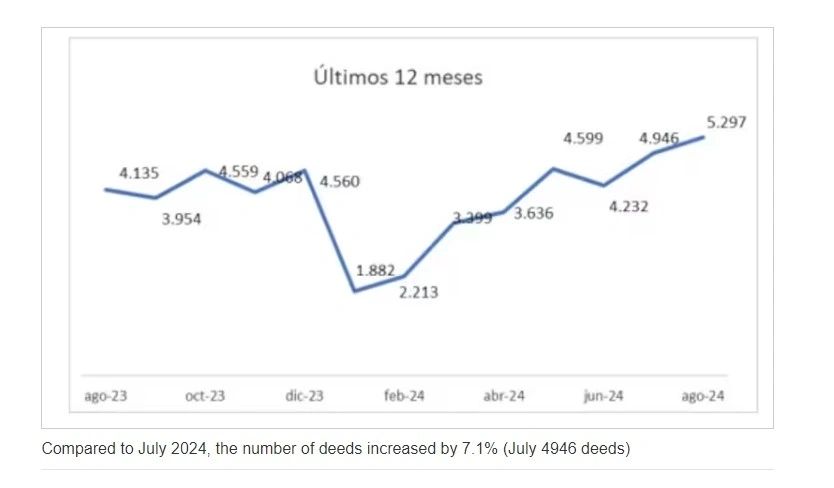

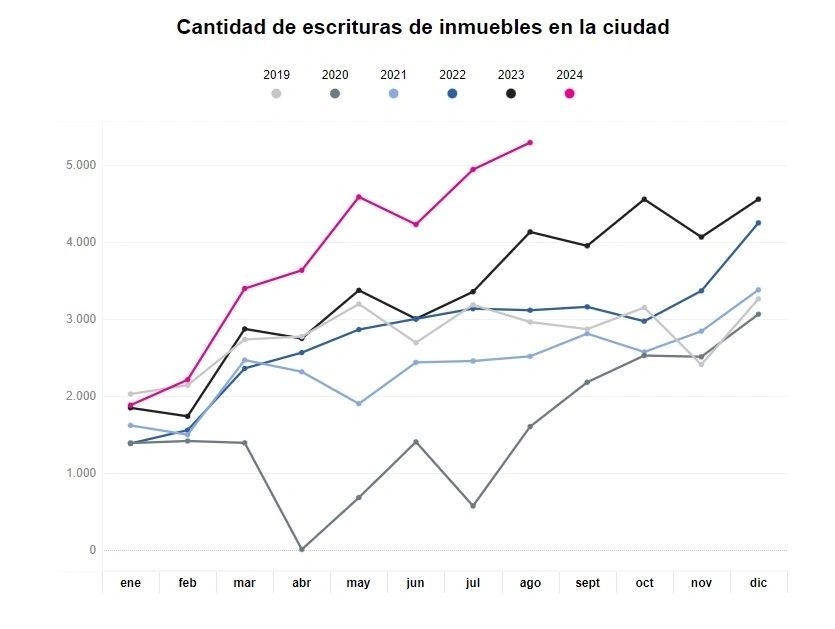

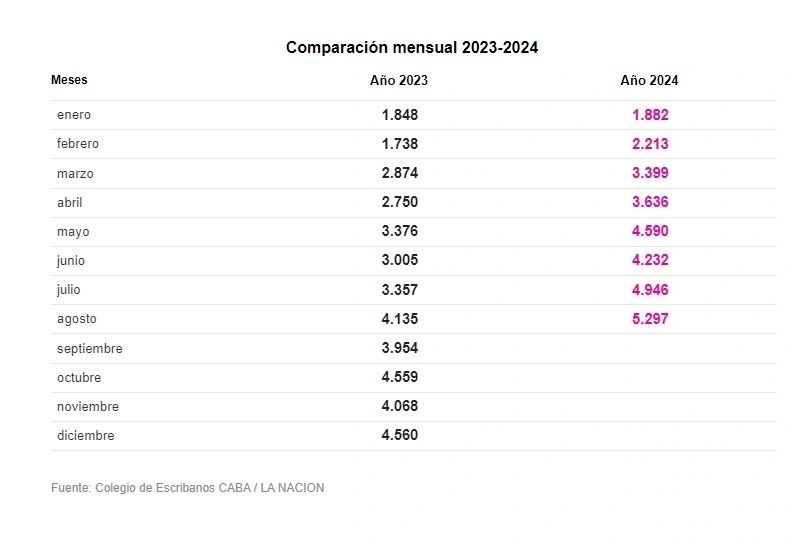

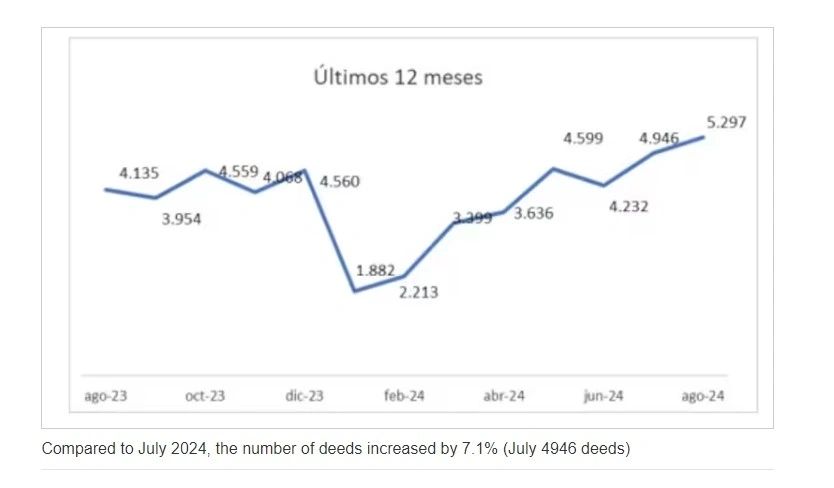

A tailwind for the real estate market ? The answer is yes. This is confirmed by the data on sales deeds carried out in August in the city of Buenos Aires with surprising numbers: the eighth month of the year was the best month of the last 75 with 5,297 transactions, which implies an increase of 28.1% compared to the same month a year earlier . However, if the comparison is made with July 2024, the data show a growth of 7.1%, when 4,946 were completed .

Regarding the total amount of transactions carried out - $515,023 million -, the report from the College of Notaries of the City of Buenos Aires reflects an increase of 287.4% compared to the same month last year. However, the average amount of the transactions was $97,229,203 (US$98,985 according to the average official exchange rate), which reflects a growth of 202.4% in one year in pesos, and 3.4% in dollars.

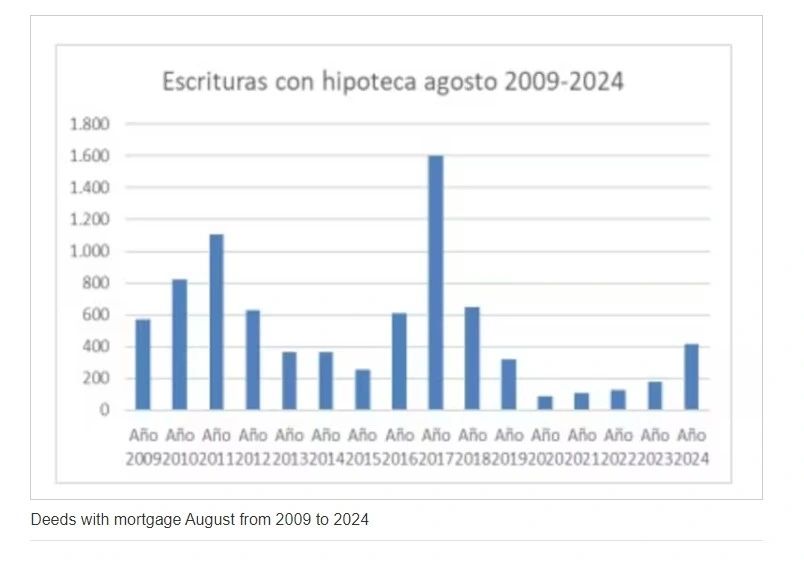

“It is the best month in the last 75 months and -as we predicted last month- we clearly surpassed 5,000 transactions. We are also seeing that mortgage lending has begun to have an impact , which, although the figures are still low, registered a jump of almost 300% in just two months . This will encourage chained transactions and we trust that it will be a virtuous circle,” says Jorge de Bártolo, president of the College of Notaries of the City of Buenos Aires.

“It is a very good figure, the truth is that we are all very happy. The market is in a positive microclimate of growth ,” says Fabián Achával, owner of the eponymous real estate agency.

The last best figure for deeds completed so far was in May 2018 , when there was a large influx of mortgage credit from the Macri government. “The contribution that new credits make to deeds is still incipient and, nevertheless, we had the best month since the fifth month of 2018 ,” says José Rozados, founder of Reporte Inmobiliario, adding that despite the growth, “it is still not the level that a city like Buenos Aires can reach or should aspire to, with the number of inhabitants it has and the interest it arouses for offshore investors.”

This rebound is encouraging for the real estate market . “The improvement in the market is widely noticeable and it is faster than it was in 2016 - when UVA began - but there is still a long way to go,” says Federico González Rouco, an economist specializing in housing, adding that “since credit processes are slow at the beginning , but abrupt at the end, it is possible to expect that 2024 will be a year of transition, looking towards a 2025 that should be considerably better, if the economic situation manages to stabilize.”

“We have to wait. If credit transactions take an average of two months to be signed, the impact will only be seen in September or October,” says Soledad Balayán, owner of Maure Inmobiliaria. De Bártolo agrees: “Credit is made in pesos and purchases in dollars, everything takes time. Banks have a lot of folders to deal with, a lot of credit already approved that is not being granted quickly.”

According to Rozados, the August deeds with credit are the first to be carried out with the launch of the lines of loans, with the help of 21 banks, and he adds: “We must highlight the growth they had and in the coming months we will see an even greater increase.” “We still need to know the additional effect that the money laundering will have on the properties. Although there are questions and concerns, it is still difficult to estimate,” he reports.

The first stage of the money laundering process ends on September 30 , when cash can be regularized and left in the financial system until December 2025 without a limit and without paying any type of tax. Another option is to use it in one of the placements authorized by the Ministry of Economy, such as in the case of projects in progress, which have a construction progress of up to 50%. In the case of laundering up to US$100,000, no tax is paid and it can be used starting October 1 .

“ There are already enquiries in notaries' offices regarding the possibility of laundering: people with small amounts of savings, who had not fully invoiced them, who accessed the blue dollar market and -with that money- want to circulate it by buying a car or an apartment, or helping their children with a donation. That will also determine the numbers for the last quarter of the year,” reports De Bártolo.

The real estate market is showing signs of recovery , with property prices on the rise since the middle of last year. Currently, the value per square meter in the city of Buenos Aires is at US$2,301 , 7% above the minimum recorded in June 2023, but still 17.8% below the historical maximum of March 2019 , according to data from Zonaprop. Specialists agree that prices are still low in historical terms , so whoever buys now could have a margin to win .

Now, we have to see what happens with salaries and how they compete with the increase in the square meter , “because if the m² increases, more salary in dollars is needed,” explains Rouco, and shares that “this jump in credits will impact the square meter, but if salaries do not improve, despite having stabilized in recent months, it will be very difficult to sustain.”

“The impact on the value will occur but in a segmented way, it is not that the values will increase in all areas and in all products equally ,” adds Rozados. “Surely the increase will occur in areas where there is a high concentration of demand , such as Palermo, Belgrano or Núñez and in products where credit is concentrated with investments with a money laundering effect,” he affirms. But, on the contrary, in the areas where there was almost no activity in the last six years, despite the fact that the credit will help to resume buying and selling, “it will be far from generating a short-term effect.”

Which apartments could increase in price with the loans? Diego Cazes, director of LJRamos, predicts that smaller and lower-value apartments, especially those between US$80,000 and US$200,000, will see the biggest price increases. “70% of people buy apartments, not houses, so there is a huge impact on a limited supply,” he says.

Iván Achával, director of Achaval Cornejo, agrees with this data and adds: “ The supply of properties today is 51% greater than it was during the UVA era with Mauricio Macri’s government, so there is still a much larger cushion to absorb the cheapest in the market first and then pass on to the rest. Without a doubt, as long as demand prevails at high levels, if mortgage loans continue to be pulled and in addition the money laundering begins to have an impact, properties will register an increase in price .”

“ We need to be patient and cautious, but everything is positive so far ,” Achával concludes.

www.buysellba.com

Source:

El dato que sorprendió y confirma que es el mejor momento para comprar una propiedad

El número ilusiona al mercado inmobiliario; en agosto los créditos hipotecarios impactaron directamente y la gran incógnita: ¿este aumento en la compra de propiedades afectará el valor de los inmuebles?

September 25, 2024

The number is encouraging for the real estate market; in August, mortgage loans had a direct impact and the big question is: will this increase in property purchases affect the value of the properties?

By Candle Contreras

August deed data encourages the real estate market Shutterstock

A tailwind for the real estate market ? The answer is yes. This is confirmed by the data on sales deeds carried out in August in the city of Buenos Aires with surprising numbers: the eighth month of the year was the best month of the last 75 with 5,297 transactions, which implies an increase of 28.1% compared to the same month a year earlier . However, if the comparison is made with July 2024, the data show a growth of 7.1%, when 4,946 were completed .

Regarding the total amount of transactions carried out - $515,023 million -, the report from the College of Notaries of the City of Buenos Aires reflects an increase of 287.4% compared to the same month last year. However, the average amount of the transactions was $97,229,203 (US$98,985 according to the average official exchange rate), which reflects a growth of 202.4% in one year in pesos, and 3.4% in dollars.

“It is the best month in the last 75 months and -as we predicted last month- we clearly surpassed 5,000 transactions. We are also seeing that mortgage lending has begun to have an impact , which, although the figures are still low, registered a jump of almost 300% in just two months . This will encourage chained transactions and we trust that it will be a virtuous circle,” says Jorge de Bártolo, president of the College of Notaries of the City of Buenos Aires.

“It is a very good figure, the truth is that we are all very happy. The market is in a positive microclimate of growth ,” says Fabián Achával, owner of the eponymous real estate agency.

The last best figure for deeds completed so far was in May 2018 , when there was a large influx of mortgage credit from the Macri government. “The contribution that new credits make to deeds is still incipient and, nevertheless, we had the best month since the fifth month of 2018 ,” says José Rozados, founder of Reporte Inmobiliario, adding that despite the growth, “it is still not the level that a city like Buenos Aires can reach or should aspire to, with the number of inhabitants it has and the interest it arouses for offshore investors.”

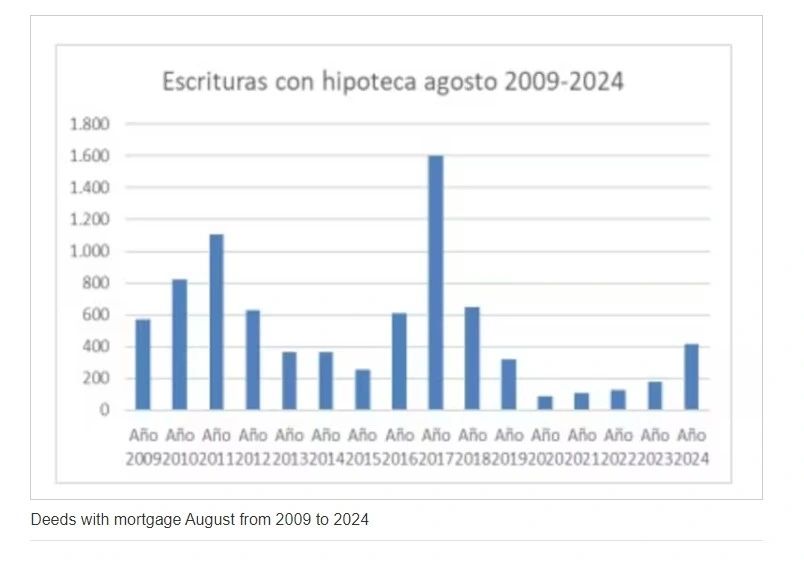

The effects of mortgage loans

As for transactions carried out with credit, in August 416 mortgage deeds were registered, which implies a growth of 133.7% compared to the same month last year and almost 300% more than 2 months ago. These numbers show how mortgage loan transactions began to grow in the market , even though it is still far from what was the record of mortgages in 2018, with a total of 2,300 in just one month. That is, in 2018 almost 40% of the activity was with credit and today it represents around 8%, but the good news is that “we have gotten out of that 3 or 4 percent hole that was evident in July.”This rebound is encouraging for the real estate market . “The improvement in the market is widely noticeable and it is faster than it was in 2016 - when UVA began - but there is still a long way to go,” says Federico González Rouco, an economist specializing in housing, adding that “since credit processes are slow at the beginning , but abrupt at the end, it is possible to expect that 2024 will be a year of transition, looking towards a 2025 that should be considerably better, if the economic situation manages to stabilize.”

“We have to wait. If credit transactions take an average of two months to be signed, the impact will only be seen in September or October,” says Soledad Balayán, owner of Maure Inmobiliaria. De Bártolo agrees: “Credit is made in pesos and purchases in dollars, everything takes time. Banks have a lot of folders to deal with, a lot of credit already approved that is not being granted quickly.”

According to Rozados, the August deeds with credit are the first to be carried out with the launch of the lines of loans, with the help of 21 banks, and he adds: “We must highlight the growth they had and in the coming months we will see an even greater increase.” “We still need to know the additional effect that the money laundering will have on the properties. Although there are questions and concerns, it is still difficult to estimate,” he reports.

The first stage of the money laundering process ends on September 30 , when cash can be regularized and left in the financial system until December 2025 without a limit and without paying any type of tax. Another option is to use it in one of the placements authorized by the Ministry of Economy, such as in the case of projects in progress, which have a construction progress of up to 50%. In the case of laundering up to US$100,000, no tax is paid and it can be used starting October 1 .

“ There are already enquiries in notaries' offices regarding the possibility of laundering: people with small amounts of savings, who had not fully invoiced them, who accessed the blue dollar market and -with that money- want to circulate it by buying a car or an apartment, or helping their children with a donation. That will also determine the numbers for the last quarter of the year,” reports De Bártolo.

What will happen to property values?

The big question is: will this increase in property purchases affect the value of real estate ?The real estate market is showing signs of recovery , with property prices on the rise since the middle of last year. Currently, the value per square meter in the city of Buenos Aires is at US$2,301 , 7% above the minimum recorded in June 2023, but still 17.8% below the historical maximum of March 2019 , according to data from Zonaprop. Specialists agree that prices are still low in historical terms , so whoever buys now could have a margin to win .

Now, we have to see what happens with salaries and how they compete with the increase in the square meter , “because if the m² increases, more salary in dollars is needed,” explains Rouco, and shares that “this jump in credits will impact the square meter, but if salaries do not improve, despite having stabilized in recent months, it will be very difficult to sustain.”

“The impact on the value will occur but in a segmented way, it is not that the values will increase in all areas and in all products equally ,” adds Rozados. “Surely the increase will occur in areas where there is a high concentration of demand , such as Palermo, Belgrano or Núñez and in products where credit is concentrated with investments with a money laundering effect,” he affirms. But, on the contrary, in the areas where there was almost no activity in the last six years, despite the fact that the credit will help to resume buying and selling, “it will be far from generating a short-term effect.”

Which apartments could increase in price with the loans? Diego Cazes, director of LJRamos, predicts that smaller and lower-value apartments, especially those between US$80,000 and US$200,000, will see the biggest price increases. “70% of people buy apartments, not houses, so there is a huge impact on a limited supply,” he says.

Iván Achával, director of Achaval Cornejo, agrees with this data and adds: “ The supply of properties today is 51% greater than it was during the UVA era with Mauricio Macri’s government, so there is still a much larger cushion to absorb the cheapest in the market first and then pass on to the rest. Without a doubt, as long as demand prevails at high levels, if mortgage loans continue to be pulled and in addition the money laundering begins to have an impact, properties will register an increase in price .”

“ We need to be patient and cautious, but everything is positive so far ,” Achával concludes.

www.buysellba.com