All the Answers

Well-known member

The country risk pierced the floor of 1,200 points and is at its lowest level since September 2020 - Infobae

Source:

El riesgo país perforó el piso de los 1.200 puntos y está en su nivel más bajo desde septiembre de 2020

Los bonos en dólares escalaron otro 4% en Wall Street y alcanzaron nuevos máximos desde que salieron al mercado. En lo que va de 2024, hay títulos que acumularon ganancias superiores al 40% en dólares

April 08, 2024

Dollar bonds climbed another 4% on Wall Street and reached new highs since they came onto the market. So far in 2024, there are titles that have accumulated gains of more than 40% in dollars

REUTERS/Andrew Kelly

Symptom of the confidence aroused by official measures in financial matters, Argentine dollar bonds rose another 4% this Monday, at renewed highs, while Argentina's country risk falls close to 100 basis points, to pierce the floor of the 1,200 units .

Market agents held public debt prices firm both locally and abroad, in response to positive expectations about the future of the domestic economy, which triggers opportunity purchases in the face of attractive returns.

The Global bonds of the exchange - in dollars with foreign law - rose 3.6% on average on Wall Street, with the Global 2030 (GD30) benchmark trading above USD 58 for the first time (USD 58.94). Meanwhile, the Bonares -with local law- gained 4.4% on average.

The largest increases of the day were achieved by Bonar 2029 (AL29, +5.9%), Global 2029 in euros (GE29, +4.9%) and Global 2035 (GD35, +4.6% ).

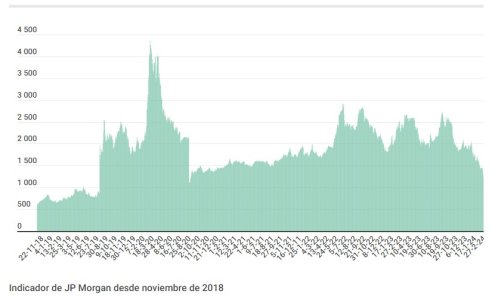

Evolución del Índice de Riesgo País argentino

In the same sense, the JP Morgan country risk index reached 1,199 basis points at 4 p.m., to settle at the close of business in New York at 1,205 integers, with a drop of 91 points on the day. This is a low since September 16, 2020 .

The libertarian Javier Milei , who assumed the Presidency of the Nation last December, seeks to clean up public accounts through a sharp cut in expenses and a reorganization of the economy.

“For now, the apex of the program has been 'going well' in a context of return of global liquidity that buys the history behind the adjustment, generating a collapse in the country risk from 2,600 basis points to below 1,200 points and a new financial holiday that today is not enough to open external credit,” reported the consulting firm EcoGo .

“As long as the Government continues to show rising reserves and falling inflation, we do not see the possibility of changing its exchange rate policy in the next 90 days, and this could lead to sovereign bonds reaching an important maximum,” considered the analyst. Salvador Di Stefano .

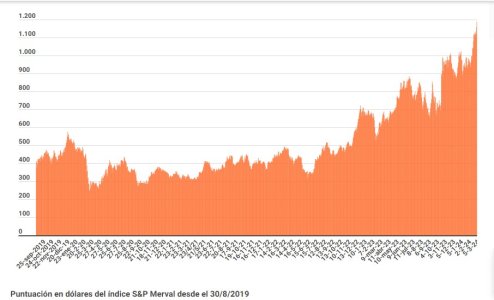

Evolución del S&P Merval en dólares ("contado con liqui")

In the Electronic Open Market ( MAE ), sovereign bonds rose on average 3.1% in pesos, after accumulating an increase of 2.5% last week and ending March with a strong improvement of 12.5 percent.

Contributing to the solidity of the debt price in foreign currency is the liquidity of dollars in the exchange market, with the advent of the thick harvest and greater volume of exports, which allowed the BCRA to buy USD 280 million this Monday and raise international reserves at nearly 29 billion dollars

“This strong acceleration of official purchases would be explained by an increase in the supply of exporters, which reached values similar to those of the liquidation period of the coarse harvest,” Portfolio Personal Inversiones evaluated . He added that "however, this time the increase would not be explained by agriculture, but rather, according to experts on the subject, it would be exports from the oil & gas sector, although there is no reliable way to corroborate it."

“Argentine financial assets have shown a positive reaction after the first hundred days of Milei's management, reaching maximum levels in the prices of hard dollar bonds -both local and foreign law- since their issuance in September 2020 and in the assets of variable income, which had not been seen since mid-2018″, he noted in an IOL (InvertirOnline) report.

For their part, Argentine stocks also traded with gains, led by the securities of energy and financial companies, which printed an improvement of 1.3% to 1,229,638 units in the leading S&P Merval index of the Buenos Aires Stock Exchange. Aires. “The area of 1,250,000 points of the S&P Merval could act as resistance,” estimated Alexander Londoño , analyst at ActivTrades.

The rise of the cement company Loma Negra stood out , whose ADR rose 11.4% in dollars on Wall Street, and 14% in pesos on the local stock market.

Market sources indicated that the official announcement of the sale of HSBC bank operations to the Galicia Group , controlled by the GFG, would be made on Tuesday. The entities did not confirm the operation, which would be around $500 million.