small MEP conversions just for everyday spending, but most are trying to spend as little as possible in ARS and avoid converting unless absolutely necessary.

exactly what i'm doing, and worded very well - thanks!

always hang on to dear dollars and not speculate

but that was NOT the action to take for the past 2 months, since prices were low for many things, and the exchange rate was fantastic in the low 1300s - so when i bought a Split, heater, bulk groceries like tuna and beer and beans and rice and flour, etc. - i actually now have a ton of food and goods that would be 25% or so higher in Dollar prices. just because long-term holding Dollars is wise (to evade taxes and maintain wealth) doesn't mean there aren't opportunities to sell some and accomplish some tasks

🙂

they are having to sell off their dollar savings to live.

sounds dramatic. did their free checks stop arriving? were they lying about being disabled? did their subsidized utilities go to a more normal rate, and they are realizing they've lived a luxury life for years and now have to face reality? the loudest complainers when free sh*t starts disappearing are those who were getting the most handouts...were their Dollar savings

not also being sold when the Peronists were in charge and the Peso went into hyperinflation and shelves were empty? i'm skeptical of these claims; overall life for normal non-corrupt people is improving in Argentina.

Things are way too unstable to trust the peso long-term. It might go up a bit here and there, but in the end, we always end up in the same place. And with elections coming up, everything just gets even more unpredictable. That IMF loan is just another bandaid, nothing’s really been solved. I’m sticking with dollars too and only converting when I absolutely need to. Not worth the risk of losing value overnight.

i'm totally tracking, but it's not just a simple dichotomy of Hold Dollars versus Hold Pesos - of course no one is buying suitcases of ARS like they were back in Iraq with their hyperinflated Dinars...but sometimes there are arbitrage/forex/conversion things we normal people can do to make life a little better. for instance, if i knew the rate was going to be in the 1100s right now, i would have converted about 2000 USD more at a rate of 1325 with Santander, and bought 2 more heaters and another Split at a great price! i took the conservative route and just did 1 of each. i probably would have had more work done by a

Gasista and

Plomero as well, paying in Pesos with that great rate.

Argentina hasn't solved any problems at all. Just got a big loan from the IMF. Still with the same problems.

I'm hanging on to dollars as usual.

sure, but you just asked me how i got a Split for so cheap compared to yours, so we also have to make sure we're taking advantage of these periods of Peso strength

🙂 Argentina has solved quite a few problems, actually...i'm sad to see you're so pessimistic. here is what Grok AI says has happened under LLA/Milei's team so far in such a short time:

--------------------

- Reduction in Monthly Inflation Rate

- Improvement: Monthly inflation dropped from 25.5% in December 2023 to 2.2% by January 2025, stabilizing prices in pesos for everyday goods and services, making budgeting easier for regular people.

- Impact: Lower inflation reduces the erosion of purchasing power, helping families afford essentials like food and utilities.

- Date: January 2025 (reached 2.2%, a 3-year low).

- Fiscal Surplus Achieved

- Improvement: Argentina recorded its first fiscal surplus in 16 years by April 2024, shifting from a 2 trillion peso deficit to a 264.9 billion peso surplus.

- Impact: Reduced government borrowing and money printing help stabilize the economy, indirectly supporting price stability and confidence in the peso for regular citizens.

- Date: April 2024.

- Poverty Rate Decline

- Improvement: The poverty rate fell from 53% in the first half of 2024 to 38.1% in the second half (July–December 2024), with extreme poverty dropping from 18.1% to 8.2%.

- Impact: Over 2 million fewer Argentinians lived in poverty, improving living conditions for many families.

- Date: December 2024 (reported March 31, 2025).

- Dissolution of AFIP (Tax Collection Agency)

- Improvement: The Administración Federal de Ingresos Públicos (AFIP) was shut down and replaced with the smaller Agencia de Recaudación y Control Aduanero (ARCA), reducing bureaucracy and staff by over 3,000.

- Impact: Streamlined tax collection reduces administrative burdens for businesses and individuals, potentially lowering compliance costs. Directors’ salaries were cut by 90%, and senior officials’ by 45%.

- Date: October 21, 2024 (announced).

- Elimination of Currency and Capital Controls (Cepo)

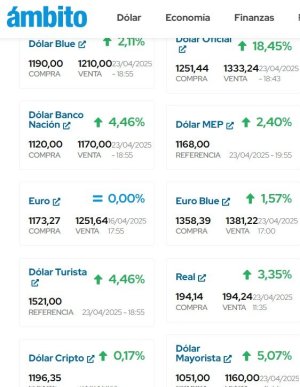

- Improvement: Currency controls were lifted, allowing the peso to float freely within a 1,000–1,400 pesos per USD band, and Argentinians can now buy/sell foreign currency without restrictions.

- Impact: Simplifies access to dollars for regular people, reducing reliance on the black market and stabilizing exchange rate expectations for savings and transactions.

- Date: April 14, 2025 (effective Monday after April 11 announcement).

- Real Wage Recovery

- Improvement: Real wages rose by 145.5% in 2024, outpacing the 117.8% inflation rate, with average wages in dollar terms reaching $990 by December 2024. Informal sector incomes surged by 196.7%.

- Impact: Increased purchasing power for workers, especially in the informal sector, allowing better access to goods and services.

- Date: December 2024.

- Narrowing of Official and Parallel Exchange Rate Gap

- Improvement: The gap between the official and parallel (black market) exchange rates narrowed significantly, from 200% in 2023 to around 30% by early 2025.

- Impact: Reduces distortions in pricing, making goods and services more affordable and predictable for consumers who previously relied on black market dollars.

- Date: Ongoing, notable by December 2024.

- Deregulation of Rent Controls

- Improvement: Rent control laws were repealed, leading to a threefold increase in apartment supply in Buenos Aires and a nearly 50% drop in real-term rents.

- Impact: More housing options and lower rents make it easier for regular people to find affordable homes.

- Date: Early 2024 (reforms implemented).

- Removal of Price Controls

- Improvement: Price controls on goods were eliminated, allowing market-driven pricing and reducing shortages.

- Impact: Improved availability of consumer goods like food and household items, though initial price spikes occurred.

- Date: December 2023 (post-inauguration).

- Reduction in Government Jobs

- Improvement: Over 30,000 public sector jobs were cut, focusing on eliminating inefficient or politically motivated positions.

- Impact: Reduced fiscal drag lowers tax burdens over time, benefiting workers and businesses.

- Date: Throughout 2024 (ongoing, reported by October 2024).

- Economic Growth Resumption

- Improvement: After a recession, GDP grew at a 3.9% annual rate in Q4 2024, with agriculture rebounding by 80.2%.

- Impact: Economic recovery creates job opportunities and boosts incomes for farmers and related sectors.

- Date: December 2024 (Q4 growth reported).

- Increased Investor Confidence

- Improvement: Investor confidence soared, with bond prices rising and Argentina’s credit ratings improving. Gallup reported consumer confidence at its highest since 2015.

- Impact: Signals economic stability, encouraging job-creating investments that benefit regular workers.

- Date: End of 2024 (reported).

- Deregulation of Imports

- Improvement: Import restrictions were eased, reducing costs for home appliances and clothing.

- Impact: Cheaper imported goods improve affordability for households.

- Date: Early 2024 (reforms implemented).

- Privatization Initiatives

- Improvement: The Ley Bases law (June 27, 2024) authorized privatization of eight state-owned entities, like Belgrano Cargas, to improve efficiency.

- Impact: Potentially better services and lower costs for consumers as private management takes over.

- Date: June 27, 2024 (law passed).

- Labor Market Flexibility

- Improvement: Ley Bases introduced measures to promote registered employment and flexible labor laws.

- Impact: Encourages job creation, especially in the formal sector, improving worker benefits and stability.

- Date: June 27, 2024.

- Reduction in Energy and Transport Subsidies

- Improvement: Subsidies were cut, aligning prices with market rates and reducing fiscal deficits.

- Impact: While initially raising costs, this stabilizes the economy, indirectly supporting peso value and reducing future tax hikes.

- Date: December 2023 (post-inauguration).

- Improved Access to Dollars for Imports

- Improvement: Businesses can now pay for imports in dollars more easily, reducing delays and costs.

- Impact: Ensures availability of imported goods (e.g., electronics, medicine) for consumers.

- Date: Mid-2024 (currency access improved).

- Auto Registry Deregulation (Nationwide Vehicle Registration)

- Improvement: The Ministry of Justice eliminated territorial restrictions for registering new (0km) vehicles, allowing Argentinians to register their cars in any province’s registry, regardless of their address, with a fully digital process. A cost comparison showed significant savings (e.g., Tucumán at 2.2% vs. Buenos Aires at 6.4% of vehicle fiscal value).

- Impact: Reduces costs and bureaucratic hurdles for car owners, enabling them to save money by choosing registries with lower fees (e.g., saving thousands of pesos by registering in Tucumán instead of Buenos Aires).

- Date: February 11, 2025 (announced by Ministerio de Justicia).

------------------------

eighteen things that are the opposite of the USA

@Betsy Ross - over there they have more spending, more debt, more wars, more censorship, more inflation, more tariffs, and more federal government. not bad, Argie-land

😀