earlyretirement

Moderator

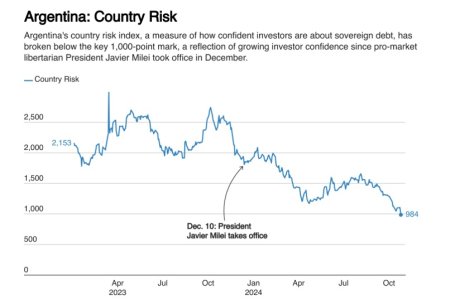

Great news that the country risk for Argentina keeps going down.

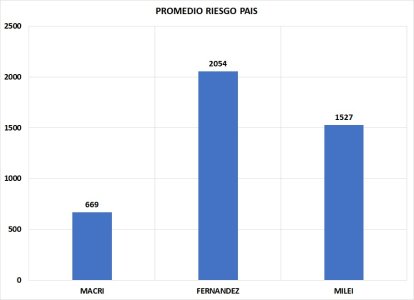

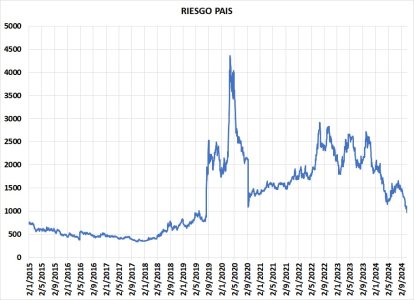

Argentina’s country risk index, measured by JP Morgan, dropped below 1000 basis points for the first time since August 2019, reaching 992 points. This decline is attributed to capital inflows from asset disclosures, Central Bank reserve purchases, and positive international negotiations. Sovereign bonds rose up to 2%, and Argentine stocks in New York increased by as much as 7%. The Buenos Aires stock exchange also saw gains. Financial optimism is driven by successful fiscal policies, decreasing inflation, and potential repo financing, with the new target for country risk set at 800 points.

www.lanacion.com.ar

www.lanacion.com.ar

Argentina’s country risk index, measured by JP Morgan, dropped below 1000 basis points for the first time since August 2019, reaching 992 points. This decline is attributed to capital inflows from asset disclosures, Central Bank reserve purchases, and positive international negotiations. Sovereign bonds rose up to 2%, and Argentine stocks in New York increased by as much as 7%. The Buenos Aires stock exchange also saw gains. Financial optimism is driven by successful fiscal policies, decreasing inflation, and potential repo financing, with the new target for country risk set at 800 points.

El riesgo país perforó la barrera de los 1000 puntos básicos

El índice elaborado por el JP Morgan se ubica en 984 unidades, algo que no sucedía desde agosto de 2019; los bonos soberanos suben hasta 2% y las acciones trepan hasta 7% en Nueva York