GlasgowJohn

Well-known member

Yip but even USD earners are suffering - they are earning 20% less in pesos than one month ago.At least all you foreigners earn in USD or other money. Locals making pesos are suffering most! You all can't complain!

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Yip but even USD earners are suffering - they are earning 20% less in pesos than one month ago.At least all you foreigners earn in USD or other money. Locals making pesos are suffering most! You all can't complain!

Exactly. We are all accustomed to blue dollar only moving one direction and strange to see locals buying pesos. I don't believe they believe in the peso so much as they are desperate and spending their USD savings to just pay the bills due to the severe inflation. My girlfriends family has been selling USD to make up the difference on paying for food, utilities, prepago/healthcare and they say their car insurance has skyrocketed as well as gas.Yip but even USD earners are suffering - they are earning 20% less in pesos than one month ago.

@Larry it looks like you were correct that it keeps getting more expensive. How is the dollar staying so weak and seems to stay around 1,000 pesos to $1USD while general inflation of the peso keeps going up. How do they manipulate it like that???Argentina keeps getting more and more expensive for those that have Dollars.

Cuánto cuesta comprar los mismos productos en Argentina, EE.UU., España y Brasil

Desde diciembre, el tipo de cambio real multilateral que mide el Banco Central cayó un 18%, lo que muestra la apreciación reciente del pesowww.lanacion.com.ar

You can read this article that discusses it a bit.@Larry it looks like you were correct that it keeps getting more expensive. How is the dollar staying so weak and seems to stay around 1,000 pesos to $1USD while general inflation of the peso keeps going up. How do they manipulate it like that???

Yes this is correct @Spend Thrift. Your banker friend is correct. This is more or less what is happening.I am not expert so don't quote me on it but I was having breakfast the other day with my neighbor that is a banker and he told. me that that Milei has turned off the printing press and they aren't printing as many pesos and there is a far lower supply of pesos since Milei took office in December. He is also cutting spending by the government. Governmental offices are getting closed and he just announced 70,000 more layoffs are coming of wasteful governmental employees that do very little to nothing.

So many locals that saved their US dollars are now having to spend all those savings and BUY Argentine pesos. Before people were buying up US dollars with their savings and their salaries. But you have a ton of spending, less printing and less pesos to go around.

Thank you for this explanation. It is very simple but easy to understand.I am not expert so don't quote me on it but I was having breakfast the other day with my neighbor that is a banker and he told. me that that Milei has turned off the printing press and they aren't printing as many pesos and there is a far lower supply of pesos since Milei took office in December. He is also cutting spending by the government. Governmental offices are getting closed and he just announced 70,000 more layoffs are coming of wasteful governmental employees that do very little to nothing.

So many locals that saved their US dollars are now having to spend all those savings and BUY Argentine pesos. Before people were buying up US dollars with their savings and their salaries. But you have a ton of spending, less printing and less pesos to go around.

Argentina has tried to manipulate the exchange rate before. However, no single entity possesses the ability to dictate or "keep" the dollar at a particular rate for long. Historical attempts by Argentine governments to maintain such control have involved spending significant amounts of borrowed $$$ to support the peso, with little success. The value of the peso fluctuates based on a multitude of factors including supply and demand, consumer sentiment, global circumstances such as worldwide events like wars and also oil prices, as well as domestic economic conditions and policies.Thank you for this explanation. It is very simple but easy to understand.

What about before? I was reading that the government would try to manipulate the exchange rate selling USD before. Is this still done? It seems like the government is saving up and building up US dollar reserves now. Can the Argentine government manipulate the exchange rate?

Hold on though. Not as simple as that. Read this:I am not expert so don't quote me on it but I was having breakfast the other day with my neighbor that is a banker and he told. me that that Milei has turned off the printing press and they aren't printing as many pesos and there is a far lower supply of pesos since Milei took office in December. He is also cutting spending by the government. Governmental offices are getting closed and he just announced 70,000 more layoffs are coming of wasteful governmental employees that do very little to nothing.

So many locals that saved their US dollars are now having to spend all those savings and BUY Argentine pesos. Before people were buying up US dollars with their savings and their salaries. But you have a ton of spending, less printing and less pesos to go around.

Exactly. And of course what is everyone doing right now? They have been selling their USD stash. So the less dollars they have the better it is for the government.The government controls the price of the dollar by buying or selling dollars through the Argentina Central Bank, but they keep strict limits on how much regular people can buy.

Milei and his team say they'll remove these limits when they think it's safe, because if they did it now, there would certainly be a rush to buy dollars. Even though they say the Argentina Central Bank dollar is close to its real value, they worry it will go up if people can buy as many dollars as they want.

Under President Milei, we don't have a freely determined exchange rate. Instead, we have what's called a crawling peg. When they came into power, the government set the value of the dollar at 800 pesos to $1USD, and they buy and sell dollars every day to make sure the value goes up by about 2% each month.

Some people think part of their plan is to cause a recession and make wages and money less available. That way, people won't have as much money to spend on dollars, especially if prices have doubled or tripled in just a few months.

I have to admit. You were right Larry. Everything is double of what it was than a few months ago.Argentina always has had inflation but not that fast.Things keep getting more expensive and that trend probably will keep getting worse. I told all of you.

Las 4 claves por las que el dólar libre vale menos que $1.000 y perdió la mitad de su valor desde que asumió Milei

El “blue” opera a $980, un mínimo desde el 15 de diciembre. Con una inflación acumulada de 90% en cuatro meses, vale 47% menos en términos reales. Por qué el billete verde es el gran derrotado en el mundo inversorwww.infobae.com

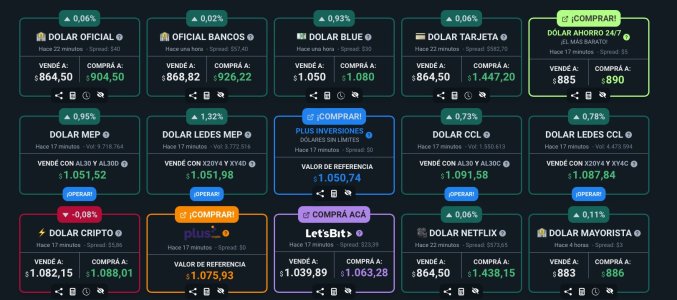

No one knows for sure. I saw a report from JP Morgan that predicted by December 2024 it would be 1,500 pesos to $1 USD but I think no one knows for sure. I have been in Argentina a long time and typically it always pays to stay in USD for the long haul. Maybe things will be different with Milei. No one knows for sure.Blue dollar continues to fall, exchange rate gap between the official and the blue is minimal.

I wonder if it will continue to go down.

Dólar hoy y dólar blue hoy, EN VIVO: cuál es la cotización del jueves 11 de abril minuto a minuto

A cuánto está el dólar blue hoy jueves 11 de abril. Cuál es el precio del dólar oficial y de los dólares financieros CCL y MEP. Toda la información que necesitas sobre cómo sigue la semana en los mercados. Bonos, acciones, riesgo país, Cedears, plazos fijos.www.cronista.com

Yeah a lot of economists is saying the peso is way overvalued. Some friends in finance tell me the USD has to strengthen against the peso. I hope they are right.The movement in the past two days is a clear reaction to the fall in interest rates. Should be interesting to see what happens the rest of the week

Receive personalized job market insights from seasoned expats in your area

Discover local cultural nuances and festivities shared by community members

Get your tailored expat living guide curated by experienced locals